|

|

The Assumption Trap

Conventional selling, on which many of today's most popular sales methodologies are based, depends on the ability of salespeople to determine the customer's decision process. These programs instruct sales professionals to find out what customers are looking for, what's important to them, what they need, and what criteria they will use to decide the purchase. That accomplished, they are directed to create a match between their solutions and customers' buying processes.

We ask salespeople if this accurately describes what they have been taught and are encouraged to do and, invariably, they say "yes". Then, we ask if they think that their customers have a high-quality decision process for evaluating their specific technology or innovative offering. Seldom is this true. The disconcerting realization: If our customers don't have a high-quality decision process, why are we trying to understand it and fit into it?

The problems resulting from deficiencies in a customer's decision process are further compounded by the tendency of the conventional selling approach to overlook the distinction between the customer's decision process and the customer's approval process. Customers always bring an approval process, they seldom bring a quality decision process. The failure to recognize the differences and treat them as one and the same leads to many Dry Runs.

You can get an accurate sense of the state of customer-driven decision making anytime and anywhere salespeople talk business together. How many times have you heard or perhaps said yourself: "My customers just don't get it"? The reality behind that statement of frustration is not too difficult to figure out: Customers don't "get it" for one of two reasons: You are either overestimating the value your solutions bring to the customer or overestimating the customer's ability to comprehend that value.

Assuming that the solution offered actually has value, the flawed logic behind the "Customer doesn't get it" complaint is that the salespeople who say it are, in essence, blaming customers for being unprepared to buy their solutions. They are implying that customers should somehow be ready to effectively analyze and evaluate products and services, such as capital equipment, that they may buy once a year or once every seven years or less. Or, even more illogically, they are assuming that their customers should have a high-quality decision process capable of evaluating leading-edge solutions, which they may never have considered before or which may be appearing in the marketplace for the first time. Technological leaders in all industries are especially vulnerable in the latter scenario. Their greatest challenge is what Geoffrey Moore calls "crossing the chasm" between the small group of visionary customers who immediately see the value of a new solution and customers in the mainstream marketplace who, through no fault of their own, truly don't yet get it. The bridge across the chasm is the quality decision process and a team of skilled professionals to guide the customer. [1]

Unless you think that salespeople are totally unreasonable, we should note that they get snared in this trap for two reasons. First, all of their training is based on the implicit assumption that the customer will bring the decision process to the table. That is the assumption trap. Second, the trap is compounded by the fact that sales professionals further assume that their customers have a much higher level of comprehension than they actually do.

The best salespeople walk into an opportunity at much higher levels of experience than their customers. They know the products and services they are bringing to market inside and out. In addition, they spend most of their time with customers. They see an entire industry, encounter a full range of operational practices, and often become experts in their customers' businesses. When we shadow experienced sales professionals, we often see them size up a customer's situation and needs, seemingly at a glance. But the advanced perspective and comprehension of sales professionals experienced in the enterprise sale stand in vivid contrast to the perspective of their potential customers. Unfortunately, even the best salespeople may make an unconscious leap of logic by assuming that their customers see the same things that they see and are, therefore, well prepared to understand their own problems and the value of the forthcoming solutions.

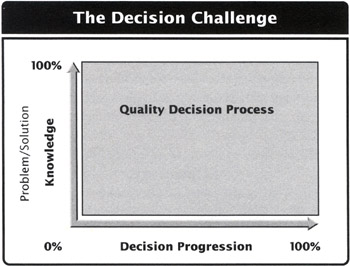

We use the Decision Challenge graph to illustrate this basic and often overlooked reality (see Figure 2.1). The graph's horizontal axis represents the customer's position in their decision process. The progression ranges from 0 percent, at which point customers have no idea there is a problem, to midpoint, where they recognize a problem and are actively investigating solutions, to 100 percent, at which point the customer has made the purchase. The graph's vertical axis represents the customer's level of knowledge about the problem and knowledge of possible solutions. At zero, customers have no knowledge of the types of problems they may have or the problems you solve; at the top of the scale, they have complete, or perfect, knowledge of their problems and the solutions required to solve them. They know everything needed to make a well-informed, high-quality decision - what to look at and for, what to measure, what to compare, what to test, and so on. Finally, the field of the graph formed by these two axes represents the customer's overall comprehension.

The big question is: Where does your typical customer fall on this graph? More specifically, where does a current client of yours fall? For example, start with the assumption that a customer has entered the market and is actively seeking solutions, knows there is a problem, and has a budget in mind. We place the average customer at 60 percent on the decision axis. Business partners tend to find their customers' knowledge of their problems and possible solutions are less complete. Often, customers have some ideas about the nature of their problems, they may have read trade publications, spoken to colleagues, and, via the same process, heard a bit about the possible solutions, but they don't have any significant depth of knowledge. Thus, we place them at 40 percent on the knowledge axis. When we plot these points on the graph, this customer's area of comprehension fills just 24 percent of the field (see Figure 2.2 on page 29). If you begin presenting solutions to this customer, he or she will understand only 24 percent of what you say.

In this example, if you attempt to communicate the value of your enterprise solution, your customer is not going to comprehend about three-quarters of what you say. More accurately, the customer's ability to connect your information to their business is greatly impaired, and they will find it neither useful nor particularly relevant. This miscommunication explains why we see low proposal-to-sales conversion ratios, long sales cycles, and extreme price pressure in enterprise sales. A customer who cannot comprehend a solution will probably not buy it, will certainly not buy it quickly, and won't be willing to pay a premium price for it. With a comprehension level that low, every solution looks the same.

The traps in the conventional sales process don't end with flawed assumptions. They are compounded by the primary element of the process itself.

[1]See Geoffrey A. Moore, Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers (New York: Harper Business, 1999), for an in-depth exploration of the challenges inherent in the introduction of newly developed solutions into the marketplace at large.

The topics covered herein concern solution sales, consultative sales, and consultative selling.

|

|