|

|

Pinpointing the Quintessential Customer

Once we understand what an ideal customer should look like, the work of the Discover stage shifts to the individual customer. Successful salespeople take the time to prepare for the initial conversation with potential customers. They construct external and internal profiles of the customer's organization and ensure that those profiles match the profile of the ideal customer. They identify the driving forces and perspectives at work in the customer's organization and become familiar with the customer's goals.

By completing this work, sales professionals lay the groundwork for a successful initial conversation. They create a basis for engagement that enables them to speak with customers using the customer's language, frame the initial conversation around issues of importance to their customers, and build a perception of professionalism in the customers' minds that clearly differentiates them from their competition.

An external customer portrait tells us what customers look like from the outside, their demographics. It includes information such as the physical details of the company (size, revenues), industry and market position, and key characteristics that differentiate it from its competitors. An internal profile has two dimensions: how companies and the individuals within them think - which we call their psychographics - and what they are experiencing, their current situation. What are the indicators and symptoms that would manifest in the absence of the value you can provide? Psychographics includes information about how its leaders and employees approach and perceive their world - the organization's strategies, its driving forces and goals, and the attitudes and beliefs that underpin the behavior and decision making of management. The situational profile points out the physical conditions that, when present, will likely drive a decision to change.

There are myriad resources that a salesperson can tap into for the previous information. The customer's annual reports, Web sites, publications of all sorts, and existing vendors of noncompetitive products; the salesperson's industry contacts and current customers in the same industry; employees in the potential customer's organization ... the list goes on and on. More important, and less common than a recitation of sources for customer information, is the content and analysis of the data we collect.

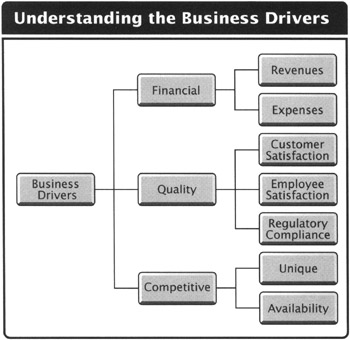

One effective way to analyze an organization is in terms of its business drivers, critical success factors or business objectives (see Figure 4.1). It is important to be able to categorize your offerings to effectively align your capabilities to your client's objectives. To simplify what could become an overwhelming list, we have determined that all business objectives can be placed neatly into one of three major categories:

-

Financial drivers are manifested by goals specifying either top-line growth via increased revenues or bottom-line growth via reduced expenses.

-

Quality drivers are manifested by goals based on increasing the satisfaction of the organization's customers, employees, or, for those in heavily regulated industries, regulators.

-

Competitive drivers are manifested by goals related to making offerings unique and assuring the availability of products or services to customers.

To identify long-term drivers, look to the customer's Web site for mission and vision statements. For short-term drivers, read the CEO's message in the annual report. It is a rare message that does not include concrete statements about the critical success factors driving the business currently and what will drive it in the near future. Confirm that the drivers identified in these sources are current (they can change fast) and then ask: To what degree are they at work in your prospective customer's business? How do they connect to your offerings?

What about the corporate culture at work in a customer's company? Personality and values trickle down from the top, so the smart profiler pays particular attention to the customer's executive committee members. What are their backgrounds? CEOs and other leaders who have risen to power have come out of different functions and, accordingly, have different perspectives. A CEO with a sales background may be focused on customer satisfaction; one with an engineering background may be more focused more on innovation. This information is often found in the public domain and is readily available.

The recent history of an organization also yields valuable clues to the atmosphere and personalities you can expect to encounter when you contact customers. Have there been restructuring, workforce reductions, mergers, and acquisitions? All of these events leave a mark on the organization and offer clues as to what objectives and emotions drive their decision-making criteria.

We close this discussion with an example of creative customer profiling at the Discover stage. A major player in the trucking industry was initiating a complete logistics management service. Its customer profile called for a manufacturer who was a forward-thinking innovator in other business processes. The team set its sights on earning the business of a major computer manufacturer. One way in which the sales team developed its understanding of the potential customer was to spend several days outside the company's manufacturing facilities. They counted the number of trucks inbound and outbound and the number of different trucking companies represented. The team talked to drivers at local truck stops to get a sense of the size of the loads, their origins, and final destinations. They used the raw data they collected to create a picture of the computer maker's logistics flow and calculate estimates of the related costs. When the sales team finally met with the computer manufacturer's management, the managers were astounded by the sales team's depth of knowledge about their operation and intrigued by the potential value that could be achieved through the company's logistics services. They elected to pursue the matter further and eventually transferred their logistics business to our client.

The point here is not that we should start camping out at our customer's facilities. Instead, it is that the better developed our profile of a potential customer is before we initiate contact, the greater our ability to create a strong value assumption; there are endless means of acquiring intelligence before the initial engagement. This, in turn, enables us to craft a one-of-a-kind introduction, one that our customers will feel was prepared specifically for them and could not be used with anyone else. It allows us to quickly hone in on the customer's critical issues, establish ourselves as professionals, and differentiate ourselves from the competition. In short, it represents extreme relevancy. This creates a compelling platform for a very constructive engagement and immediate and complete access to the customer.

The topics covered herein concern solution sales, consultative sales, and consultative selling.

|

|