Westside Toastmasters is located in Los Angeles and Santa Monica, California

Starting Out as Column B

We've already alluded to the advantages of starting out as Column A—that is, of being the vendor whose offering is perceived from the outset as the best match with the requirements of the buyer.

We believe salespeople who are called into or stumble on opportunities where buyers already have budget for the project should assume that they are not Column A. (The vendor who has initiated the evaluation that led to this opportunity is Column A, and will continue to enjoy this position unless or until another vendor is able to change the buyer's requirements.) In creating demand, therefore, we believe it is vitally important to cause organizations that are not currently looking to change to start looking to change.

Let's examine how much better your chances are as Column A versus Columns B, C, D, and so on, the inhabitants of which we sometimes refer to as "silver medal" vendors. Have you ever noticed that only one vendor gets the order (gold medal)? The other four are told: "We liked your proposal best, but I'm sorry to tell you we awarded the business to another vendor. You came in second." Here is a scenario that may be familiar:

A salesperson sits at her desk, debating whether to work on overdue expense reports or make some cold prospecting calls, when the phone rings. A prospect in her territory begins the call:

I'm Ray Jones, project manager for XYZ Company. The reason for my call is that we are going to make a buying decision within the next month. I already have budget approval for the project. We've heard good reports about your company and products and would like to give you a shot at earning our business. We'll need a demonstration, price quotation, references, and a proposal as soon as possible. You should be aware that this ultimately is my decision, so there's no point in looking for ways to go around me. How soon can we meet to discuss these items?

In the wake of this kind of call, most traditional salespeople would feel fortunate to have been invited to compete for the business. The appointment would be scheduled for the earliest possible time, the salesperson's manager would be informed that there was a "hot one" in the funnel, and this opportunity would appear on the salesperson's next forecast. The pricing, references, demonstration, and proposal would be expedited to meet the prospect's tight timeframe. Everyone in the selling organization would be feeling a little giddy.

Before we allow ourselves to get too excited, however, let's examine the sequence of events that most likely preceded the call's being placed to the salesperson. (This is a composite, based on lots of stories like this that we've heard.) Is this a hot prospect?

Six months ago, Salesperson A uncovered a requirement for a product that XYZ Company had never considered, which meant that no budget had been established for this purpose. The sales cycle started at a lower level within the organization. After months of effort and education, a base of support and an overwhelming business case was built for Salesperson A's product, which cost $100,000. The internal champion could see the value of buying the product, but needed to obtain approval for an unbudgeted expenditure.

After the business case and an attractive payback were presented, the CFO said: "You've put a lot of effort into this evaluation, and it sure looks as though the benefits far outweigh the costs. What other vendors have you looked at?" The internal champion answered, truthfully, that no other alternatives had been considered. "Well," the CFO continued, "our corporate policy is never to consider just one vendor for a purchase of this magnitude. Get other quotes so we can make product and pricing comparisons. And by the way, please don't bring any salespeople in to meet with me. How soon can you perform this analysis and get back to me?"

After this meeting, the internal champion at XYZ Company has a sense of urgency about completing the requested analysis. To get funds allocated, he must perform due diligence by considering other options. But how objective will his evaluation really be? Naturally enough, he wants his initial vendor recommendation to be the chosen alternative. After all, Salesperson A initiated the sales cycle, showed strong potential payback, and spent months developing a relationship. The internal champion may confess to Salesperson A that he is required to look at other vendors, and solicit her advice on which ones to consider. What he may not fully understand is that Salesperson A also anticipated that her prospect would be instructed to look at competitors, and has prewired (biased) the requirements list to play to her product's strengths.

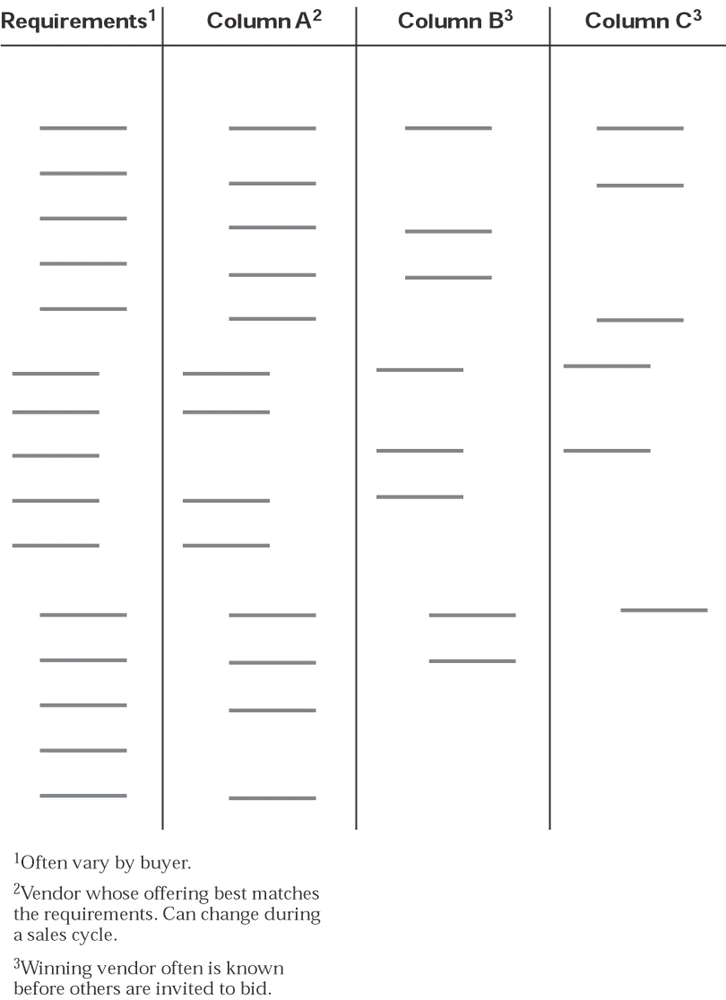

What does this list (see Figure 9-1) look like? The requirements column on the left is filled out first: a detailed description of the only product that has been evaluated to date. Column A is just to the right of this column. It is filled in completely, and—not surprisingly—it is more or less an exact restatement of the requirements column. To the right of Column A are blank columns for Competitors B, C, and D to fill out. The internal champion is now ready to call and invite the silver medalist candidates to bid on the business, provided they can pull all the numbers together by the deadline.

How well will the competitors compare? If Salesperson A's product is price-competitive, Competitors B, C, and D have little chance of getting the business. If Salespeople B, C, and D ask for the opportunity to meet the CFO—who could potentially change the requirements—they will be denied that opportunity. Even if one of them were successful in adding new features to the requirements list, weighting factors could still be used to ensure that Column A would win. If a lower bid comes in, Salesperson A may be given a clandestine opportunity to sharpen her pencil after all quotes are received. In other words, Competitors B, C, and D have been invited to compete, lose, and ultimately help the internal champion do business with the vendor he wanted from the start. In most cases, the reward for Columns B, C, and D is the silver medal.

Column A's internal champion next schedules a follow-up meeting with the CFO. Although multiple alternatives are shown, there is a clear choice. Reallocated money for Column A is approved. Vendors B, C, and D are thanked for their responsiveness, complimented on doing an excellent job, and told that it was a difficult decision, but that they were not chosen this time. All three are told that they came in second, and that if future requirements arise, they'll be invited to bid. The losing vendors remove XYZ Company from their forecasts as a competitive loss, feeling—correctly, in many cases—that they could have turned the situation around, if only they had gotten into the account sooner.

In short: When you are told early in a sales cycle that the budget has been approved, you should always assume that your competition has set the criteria. The prospect has already started to evaluate the merits of comparable products or services being offered, and has obtained cost estimates. If this were not the case, how could they possibly know already how much money to budget?

Being called by prospects with preapproved budgets and tight deadlines for providing demonstrations, pricing, references, and proposals should warn you that you are being asked to provide a column. If the answer to the question, "Is there a budget?" is yes, sales managers may want to ask an additional question: "Whose numbers did the prospect use for obtaining budget approval?"

In our client engagements, we try to get our audiences focused on the advantages of being Column A, as opposed to being silver medalists. One way we do so is to ask them to look back on the competitions they've won over time, and to estimate the percentage of those wins that represented situations in which they started as Column A.

Most people wind up giving a number in the 80 percent range. Flipped the other way around, this means that they have a 400 percent better chance of success if they can proactively cause people to look to change. Yes, individual salespeople should prospect to fill their funnels, but Marketing also has a critical role to play as the front end of the sales process.

It should be noted here that the perceived average sales cycle for a company could be misleading. Even if you are calling high, when you are Column A, a fair amount of time is needed to get to the point of having a closable order. When you are coming in as a potential silver medalist, the good news is that it will be a short sell cycle (Column A has already done most of the selling). The bad news is that the sales cycle is likely to have an unhappy ending.