Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 12: Qualifying Buyers

Overview

Many organizations have great difficulty forecasting top-line revenues. We believe that this reflects an underlying problem: Pipelines are full of unqualified buyers. Most organizations have no standard way of accurately assessing which prospects are likely to buy.

Our strong sense—as will become clear below—is that the sales manager should disqualify buyers, based on the best available correspondence between the salesperson and the prospect. The alternative is to abdicate this responsibility to individual salespeople, which almost inevitably leads to unqualified buyers being in the pipeline, resulting in inflated top-line revenue estimates. So how do the sales manager and the salesperson work together to qualify buyers, build pipeline, and develop more accurate forecasts?

A prerequisite is to agree on a standard set of terms describing the Key Players involved in making buying decisions. This facilitates qualifying multiple Key Players who play different roles in a given opportunity. A prospect with all roles filled is a better bet at forecasting time.

We define Key Players as being those individuals whom a seller must access in order to sell, fund, and implement the offering. As you would expect, the number of Key Players is proportional to the size and complexity of what is being sold. Here are our definitions of the Key Players:

Coaches want the seller to win the business, and are willing to provide information and do inside selling. They have only limited authority within the organization, but they can serve as the eyes and ears for a salesperson as an opportunity develops.

Champions provide access to Key Players, as requested by the salesperson, and can be found at any level within the prospect organization. Generally speaking, the higher within the organization your Champion, the better your chances of success and the shorter the sales cycle. The ideal situation is to have your Champion also be the decision maker (see below). In such cases, the buyer will often volunteer access to other Key Players even before the salesperson asks for that access, and this access will be to people below him or her in the organization—a good thing. While bottom-up access is necessary at times, the first choice is top-down.

Decision makers can make the vendor selection and cause unbudgeted funds to be spent, which (as explained in earlier chapters) is critical if a seller initiates a buying cycle in an organization that wasn't looking to change, and therefore had no budget for change. In addition, a decision maker can commit internal resources to evaluate a salesperson's offerings. In the case of purchases by committees, there can be multiple decision makers.

Financial approvers are the people who must sign off on expenditures. Their role can range from being passive (rubber stamp) to being an active and involved player in the decision process. Gaining financial approval is easier when this person understands the value of addressing the goals the organization wants to achieve.

Users and managers of users are people involved in using the offering. For implementations affecting a wide group of people within an organization, supportive and enthusiastic users can be critical to a seller's success. Users can help sales campaigns by providing a groundswell of support. (Conversely, their reluctance or skepticism can scuttle an otherwise viable opportunity.) Users don't usually have business goals. Their concerns are more personal: They want to decide if the offering will improve their stock in their company and simplify or complicate their lives. It's rarely possible for a seller to interface with all potential users, but getting (at least) some opinion leaders on board—including, for example, managers of users—can be a critical step in making the sale.

Implementers are the people responsible for migrating from the current method to the new offering. Often their major concern is not a corporate objective. They will be measured on their ability to integrate the new offering on schedule and under budget. They prefer doing business with vendors that offer professional services and ongoing support.

Adversaries are individuals who either don't want to change, want to control change internally, or want to do business with a competitor. They can include, for example, Champions for a competitor, individuals whose power is derived from the current method of doing things, IT staff members who want to develop the desired capability internally, and so on.

In our experience, salespeople tend to avoid their Adversaries, which is generally a mistake. A salesperson's objective should be to convert, neutralize, or eliminate Adversaries. Of course, this needs to be done carefully. For example, a one-on-one meeting can be confrontational, and can further polarize opposing positions. Instead, we suggest including people who are on your side when you meet with Adversaries—preferably, a proponent who outranks your Adversary.

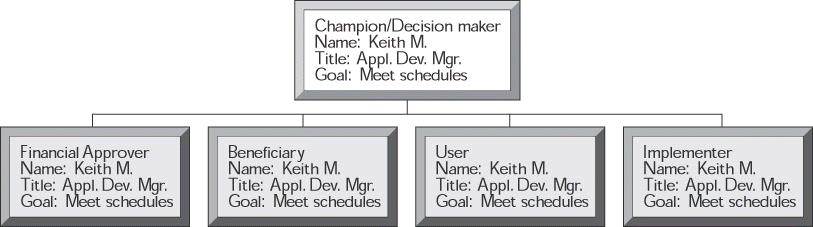

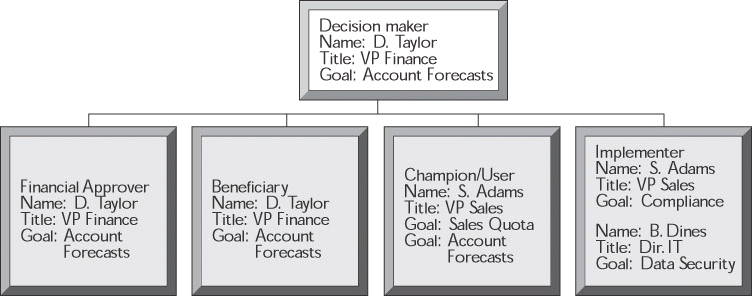

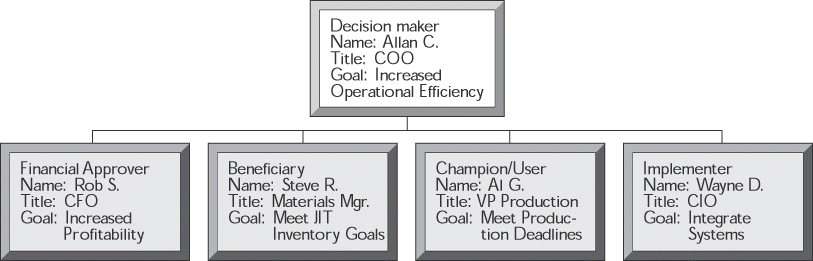

These definitions of members of the buying committee become the basis for discussing and developing strategies for specific opportunities. Look at Figures 12-1, 12-2, and 12-3. In these charts, we've laid out three different sized opportunities and identified the Key Players and their associated titles and goals. (Note that there are occasions where a Key Player plays more than one role.) Also note the emphasis on goals: the starting point of all Customer Focused Selling.

This may look like a lot of extra work. But given a simple organizational chart software package and a little practice, it should prove relatively easy. And in our experience, understanding, preparing, and updating simple charts like this helps both the salesperson and the sales manager, as they work together to qualify opportunities.