Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 9: Corporate Strategies

Overview

Translating Market Strategy into Sales Results

Business experts portray many different, and often conflicting, elements of corporate success. Some focus on innovation; others, on human capital; still others, on product and service quality. Some even focus on focus. The list goes on and a good case can usually be made for each element. But unless a company can translate its value proposition into profitable sales results, not only will the funding that all of these elements of corporate success require never materialize, but the very existence of the organization will be threatened.

The translation of value proposition into bottom-line profitability is accomplished through a go-to-market strategy that encompasses a company's market, competitive, and product strategies. Together, these elements feed into the sales strategy. Its formulation and execution is the critical work that lies at the heart of a business. The go-to-market strategy cuts across departmental functions. It directly involves the product development, marketing, sales, service, and support functions; it indirectly involves almost every other function in the business.

As with any strategy (and assuming that the resources and skills are already in place), there are four prerequisites for the successful execution of a go-to-market strategy. There must be:

A high level of understanding of, and agreement on, the business strategies in place to acquire, expand, and retain profitable customer relationships. Is everyone in the company united by a shared vision and a common effort?

A successful transfer of business strategies to departmental and individual responsibilities that encompasses both quantitative and qualitative objectives. Does everyone in the company know what they, individually and as part of a group, must accomplish to successfully achieve the defined objectives?

A monitoring and measurement capability that enables leadership to assess the performance of the departments and individuals as they progress toward their objectives. Can everyone monitor their progress toward the achievement of those objectives?

A capacity to anticipate and correct the most frequently occurring issues and obstacles blocking the successful execution of the strategy. Can everyone learn from their mistakes and respond and adapt to changing conditions?

We see many go-to market strategies fail to generate profitable results precisely because one or more of these prerequisites are ignored. For example, we encountered a company in the insurance industry that fell prey to this trap when it abruptly changed its go-to-market strategy. The company had been targeting small, blue-collar companies, such as plumbing and roofing contractors, but as the business environment changed, management decided to sell to larger, white-collar businesses. The new go-to-market strategy was delivered to the 250-member salesforce. Instead of calling on roofing contractors, they were instructed to call on medical practices, IT consultants, and law offices. Unprepared to deal with this new prospect base, the sales-force's closing ratios quickly plummeted to below 4 percent. (Interestingly, the company decided to take the traditional sales-by-numbers approach to counter poor performance. The salespeople were pressured to make more calls and give more presentations to raise their results. This is a classic example of selling harder instead of smarter.)

This example again highlights a major limitation of the conventional sales process: It offers only one response to downturns in performance - do more of what you are already doing. That response does not enable a company to address fundamental problems, gaps, and disconnects in its go-to-market strategy. Worse, as salespeople put more time and effort into a system that isn't working, they burn through valuable prospects, and the negative performance cycle is often exacerbated.

The conventional sales process is what an information technology expert would call a legacy system. In the computer world, legacy systems are usually outdated networks that were originally developed for limited, local purposes. As holistic, organizationally integrated networks are developed, these systems must either be modified or replaced. The conventional sales process is a legacy system in that it offers the sales department a way to communicate internally, but it doesn't connect the sales function to the rest of the organization in any meaningful way. It does not offer a common language or the filters through which sales and the other functions in the business can communicate and respond. In this sense, it contributes to the "black box" view of sales.

The black box view of sales is an attitude that we frequently find among senior executives who do not have sales experience. To them, the workings of the sales department are largely a mystery. They can set goals and send them into the black box of the salesforce, and they can tell whether those goals have been reached - after the fact. But they can't effectively manage what happens between the two points. Sales are a black box that senior management hopes will deliver the required results.

What we need is a process that can make the black box transparent - that is, capable of connecting the sales function to the rest of the organization in strategic terms and creating a common language and process through which the go-to-market strategy is formulated, executed, and monitored.

This process should also allow management to pinpoint the source of performance shortfalls. As one senior vice president in a Fortune 100 company mentioned, "The most frustrating things about poor sales results are not knowing where the problem originates within the organization and the finger pointing that results when you try to trace it." Our sales process enables managers to pinpoint inefficiencies in their strategies and tactics.

Organizational Alignment and Learning

Two mechanisms must be present during the creation and execution of a go-to-market strategy. First, there must be a mechanism capable of generating strategic alignment, deployment, and results measurement within the organization. We need to ensure that everyone in the organization is speaking the same language and working in a coordinated fashion toward the realization of the plan. Second, we need a mechanism for communicating and applying the learning that is generated as our strategic plan bumps up against the realities of the marketplace.

Strategic Alignment

The division of labor into specialized tasks was, and is, a primary support in the development of the modern organization. Around the time of the American Revolution, Adam Smith glowingly described the efficiencies inherent in specialization using the example of a pin factory. [1] Specialization, however, had a downside that Smith did not anticipate. Specialists don't always see the big picture, and different specialties often have conflicting goals.

The division of labor creates boundaries between functions, and those boundaries develop into walls. We call the divisiveness inherent in the specialization of labor the Great Wall Syndrome, and we often see its negative impact on the performance results of the companies with which we work. When companies suffer from the Great Wall Syndrome, the formulation and execution of strategies are segmented and isolated into functions. One department completes its work in isolation from the other functions within the company and tosses it over the wall into the next function. Each successive department does the same until the goal is achieved. [2]

In Smith's eighteenth-century pin factory, the isolation of functions was not a particularly serious matter. But in today's diverse organizations, this isolation is one of the primary causes behind the failure of corporate initiatives and other change efforts. The most common results of the Great Wall Syndrome include inefficient strategy execution, inhibited communication, and slowed response times to customers and the marketplace. For instance, we've seen designers create new products with little or no input from the rest of the organization (or customers themselves); marketers create advertising campaigns and literature in a vacuum and salesforces uncover major customer needs and fail to report them.

What's missing here is the alignment of functions around the corporate value proposition. Organizations need a mechanism that can create a cohesive team, communicate and reinforce messages, get everyone working toward the same goal, and measure the progress toward that goal. Everyone in the organization should be concerned with how to create and capture value for customers. Everyone should feel a responsibility for the welfare of the customer.

One way to generate alignment around corporate goals is to require that each function involved in the formulation and execution of the go-to-market strategy cycle through the four phases of the sales process. The four stages of our method - Discover, Diagnose, Design, and Deliver - offer a single, customer-centered process through which each organizational function can explore the marketplace and ensure that their efforts are aligned with the functions.

The pharmaceutical industry is a good model of how this alignment mechanism plays out in the real world. When the R&D function of a prescription drug maker undertakes the creation of a new product, it uses a process that can be framed around the four phases of the sales process. R&D seeks to Discover a market of patients that is large enough to support the investment required to create a new drug. It Diagnoses the indications, causes, and consequences of patients' problems. It seeks a Design that will best solve the problems. And it Delivers the new drug through a highly regulated process of testing and government approvals.

The process is repeated as the company's marketing function and then the sales function create and align their efforts to bring the drug to the doctors and health care organizations that will prescribe it. The discovery process is used to segment and refine the markets for the drug. The indications of each segment are diagnosed, the solution design is altered to fit each, and the solution is delivered.

The doctors who prescribe the medication repeat the process yet again. They discover the profile of patients who are likely to need the drug, diagnose the individual case, design the proper dosage, and then prescribe the best solution and monitor the patient's progress throughout the delivery phase.

Each cycle of the process builds on the one before it; each is aligned with and supports the total effort. We can apply these same four phases to any product or service that grows out of a corporate value proposition. The major impact results from the accumulation of knowledge by each function and the efficient transfer of that knowledge as the product moves from development to deployment. In the absence of our sales process, there is a significant dilution of the ability to create and capture value as the organization moves from creating a strategy to creating results.

Organizational Learning

The second mechanism that enables the successful execution of a go-to-market strategy is the capacity to learn. MIT's Peter Senge popularized the idea of the learning organization in the early 1990s. A learning organization, he wrote, is an organization where people continually expand their capacity to create the results they truly desire, where new and expansive patterns of thinking are nurtured, where collective aspiration is set free, and where people are continually learning how to learn together. [3]

Interestingly, when Senge identified the seven learning disabilities common in today's organizations, the first was the fact that employees tend to identify with their jobs and limit their loyalty to their functional responsibilities. This identification and loyalty, said Senge, does not extend to the purpose and vision of the larger organization. The Great Wall Syndrome strikes again!

The problem, of course, is that when learning is stifled, so is the ability of the organization to adapt and respond to customers and, ultimately, so is profitability. Some of the largest and most successful of today's businesses were born out of the inability and/or unwillingness of existing companies to respond to the marketplace.

Intel Corporation is a notable example. In the late 1960s, Fairchild Semiconductor, which was owned by Fairchild Camera and Instrument, was one of the nation's hottest high-tech companies. Two Silicon Valley legends, general manager Robert Noyce and head of R&D, Gordon Moore, were the guiding forces behind the company's success, but their ability to respond to the fast developing market for integrated circuits was being blocked by the parent company.

"I was running the laboratory and having increasing problems trying to push product ideas through Fairchild's management before they were pursued by a half dozen startups around the valley," explained Moore. "It was just a good time for us both to go do something new." [4] Moore and Noyce's "something new" was Intel, a company that raised $2.5 million in startup capital in a single afternoon in July 1968 and went on to become the 800-pound gorilla of the semiconductor industry. In 2001, Intel recorded revenues of $26.5 billion; Fairchild Semiconductor's revenues were $1.4 billion. I like to call it the "two guys in a garage syndrome." The question is "Are there two guys in your organization that are feeling the need to do something in their garage to respond to your customers?"

Whether an organization must respond to new opportunities, changes in the market environment, or correct miscalculations in its own go-to-market strategy, it must have a mechanism capable of capturing and responding to feedback. It needs to be able to identify, communicate, and respond to customer needs throughout the value creation process. When this process is distributed across the organization, it can serve as that mechanism.

This process requires that the various functions within the organization charged with delivering value to customers take to the field in one voice and one process. To effectively discover, diagnose, design, and deliver, they must frame their assumptions in terms of the customer, and they must test those assumptions against the reality of the customer's world. We want the R&D professionals to view their ideas and creations through the sales process. We want to push marketing and product development out into the real world where they can directly observe the symptoms of the absence of value, and experience first hand the pains that their customers feel. We want the salespeople to communicate the issues they uncover as they conduct a diagnosis, and we want service and support staff to report the issues they find during the delivery and implementation of solutions. This ongoing diagnostic feedback loop creates a learning flow that, in turn, can be used to generate continuous improvement and breakthrough innovation.

How might this play out in the everyday world of business? Picture a financial software maker that has a 250-member salesforce calling on CFOs around the world. As the salespeople are busy diagnosing the problems that their prospects are experiencing, they are developing valuable information. If at the end of a month, they report back that 76 percent of the CFOs that they have called on are experiencing and have identified "Issue X" as their greatest concern and relay that information to marketing, how soon can a 50,000-piece mailing aimed at CFOs having trouble with "Issue X" be in the mail? And if the company's software does not already address "Issue X," how soon after the information is delivered can the programmers modify an existing product or develop a new one that does address the issue?

[1]Smith's famous example appeared in 1776 in his book, An Inquiry Into the Nature and Causes of the Wealth of Nations. It illustrated how 10 workers could raise their combined output from under 200 pins per day to over 48,000 pins per day by dividing their labor so that each worker performed only one repetitive task.

[2]This is also known as the Silo Effect.

[3]See Peter Senge's The Fifth Discipline: The Art and Practice of the Learning Organization (Doubleday); Peter Senge, Art Kleiner, Charlotte Roberts, Richard Ross, Bryan Smith's The Fifth Discipline Fieldbook: Strategies and Tools for Building the Learning Organization (Doubleday) for a complete exposition of his ideas.

[4]Gordon Moore is quoted from an interview conducted by Anthony Perkins, "The Accidental Entrepreneur," Red Herring (September 1995).

An Integrated Business Development Map

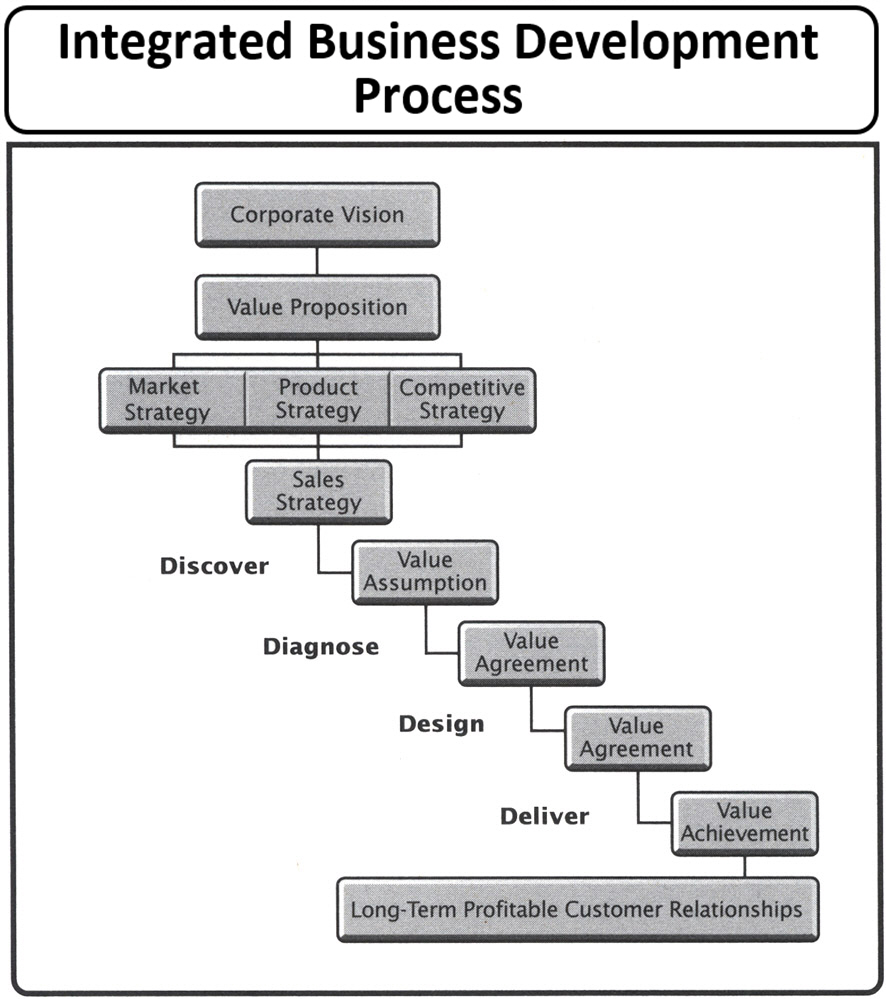

Now that we've talked about the prerequisites necessary to successfully execute a go-to-market strategy and the mechanisms that create them, we can take a high-altitude look at the way in which a go-to-market strategy is achieved. This sequence of events that forms a path from the corporate vision and value proposition to the ultimate goal of a business - the establishment of profitable, loyal, long-term customer relationships, is called the Integrated Business Development Map; its flow is illustrated in Figure 9.1.

This map is focused on the creation of value. An organization's concept of value grows out of its vision. This vision provides the framework from which its corporate strategy evolves and a value proposition is derived. The value proposition, along with the products and services it generates, is delivered to the customer through a series of strategies that together comprise a go-to-market strategy.

The market strategy defines the marketplace in which the company will do business. It identifies the markets and market segments in which the company will sell its products and services. The competitive strategy defines a company's position with regard to other organizations within its market spaces. It identifies other companies vying for business in the same marketplaces, evaluates their strengths and weaknesses, and offers a plan to successfully compete against them. The product strategy defines the company's products and services. It determines how each will fit the particular market segment for which it is designed. Finally, sales strategy defines how the company's product and services will be offered to customers. The sales strategy is created at three levels: the customer or enterprise level, the opportunity level, and the individual or appointment level. It details the content and flow of the sales process and diagnostic strategy. The corporate value proposition is the cornerstone that supports each of the four strategies. The purpose of those strategies is to deliver the promise of the value proposition to market and, ultimately, to individual customers. The process unfolds through the same value sequence described at the end of Chapter 3: The value proposition is extended to the market, yielding assumptions about customers' situations and the ability of the company's offerings to address those issues; the value assumption is explored, yielding agreement about the problems being experienced and their best solutions; and the value agreement is delivered and, in turn, yields value achievement.

The process is traveled twice in the creation and delivery of value. The first pass through the process occurs as each of the four strategies under the go-to-market umbrella is developed. In this way, a company can ensure that each element of its strategic plan for creating value is aligned to the needs of its prospective customers. We confirm that we can leverage value via the product, process, and performance levels of our customers organization. In other words, we want to be sure that our strategies are capable of delivering value during their planning stages before we devote the full resources of the organization to realizing them.

The second pass through the Integrated Business Development Process occurs during the execution of each of the four strategies. In this pass, a company ensures that each strategy actually works as planned and makes any necessary corrections in real time. In other words, we want to ensure that each strategy succeeds - that it fulfills the value proposition we are bringing to market and creates the expected value assumption, agreement, and achievement.

When the Integrated Business Development Process is successfully traversed, the go-to-market strategy is realized, value is delivered to customers and value is returned to the business in the form of increased margins. The by-product of this end result is the lifeblood of corporate success - long term, profitable customer relationships. The corporate vision has been transformed into bottom-line results.