Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 17: Driving Revenue via Channels

Over the past several years, many organizations have chosen to supplement their direct sales forces with - or even rely exclusively on - sales channels to drive top-line revenue. These indirect organizations include value-added resellers (VARs), distributors, and partners, to which we'll refer collectively as "channels."

These salespeople are not employees of the companies whose offerings they represent and sell. Microsoft is one of the most notable successes in driving a high percentage of their nonretail business through channels. Their channels have not only provided sales presence, but have also allowed Microsoft to minimize the hiring of technical support people to assist in implementations. This approach has been vastly different from that of many other technology companies, which have added support staff as direct employees.

Getting the Right Coverage

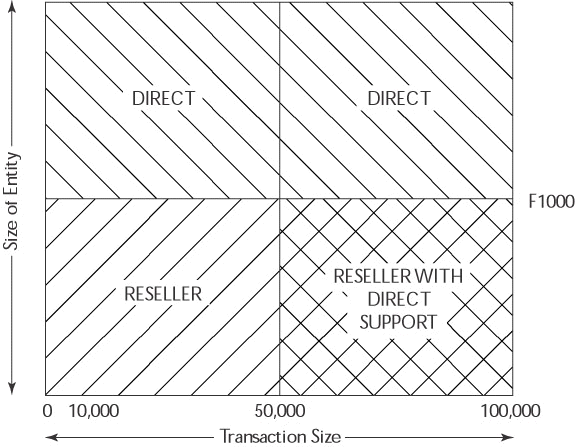

For companies that are attempting to use both direct and indirect salespeople, one of the challenges is to define which market segments should be assigned to each, in order to maximize coverage and minimize conflict. We worked with a client selling software ranging from under $10,000 to more than $500,000 who utilized both a direct and an indirect sales approach. We helped them define the desired coverage by working through the chart in Figure 17-1.

The criteria used to determine responsibility were account size on the y axis (with the Fortune 1000 being a threshold) and opportunity size on the x axis, with $50,000 or higher being designated as a major opportunity and below $10,000 being handled over the phone exclusively. Everyone was comfortable with his or her strategy, and we agreed that it was well thought out.

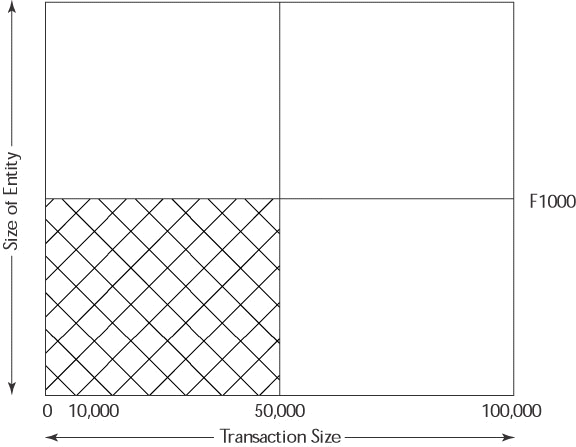

After we had collectively defined the desired coverage, the next logical question to ask was, "What does the actual coverage look like, today, in the field?" The room was quiet for a few moments. Finally, the most senior executive in the conference room volunteered his opinion - subsequently endorsed by everyone else - that the most extensive coverage was in the quadrant of non-Fortune 1000 accounts under $50,000 (see Figure 17-2).

Further discussion brought out the fact that most of the company's salespeople (both direct and indirect) were engineers who were most comfortable calling on engineers - for the most part, non-decision makers. Interestingly enough, their direct salespeople were receiving an override on sales made by the channel. In some cases, in fact, direct salespeople were achieving quota while closing little or nothing themselves.

Gradually, it emerged that the firm's underlying problems lay in two areas. The first was that their direct salespeople did not know how to position their offerings for nontechnical business people. Sales-Primed Communications and a sales process were used to address this issue.

The second problem was inconsistency and conflict between the desired coverage and the compensation plan. While management can make their wishes known, the best way to influence a salesperson's behavior is to reinforce it with a commission structure. Part of the reason for the decision to implement an indirect channel was to decrease the cost of sales. But in their current situation, the company was actually paying duplicate commissions to both direct and indirect salespeople on most transactions.

By implementing recommendations, direct salespeople were weaned from their overrides on sales by the channel over 6 months. After that time, the commission plan structure drove them to pursue only Fortune 1000 accounts. When some direct salespeople were unwilling or unable to execute these enterprise sales efforts, they were encouraged to join VARs so that they could continue selling within their comfort zones for small to mid-size opportunities. The channel was given a different compensation structure, receiving 100 percent commission for sales to non-Fortune 1000 accounts that did not require sales support from the manufacturer. They could request support on sales of over $50,000, but in these cases they received only 80 percent of their sales commission.

Who's in Charge?

It is essential that the compensation plan for a sales organization reflect management objectives. Even in the best of circumstances, however, the control that vendors can exert over channels is tenuous when compared with that over a direct sales force. They must attempt to influence without having authority. Control of channels is difficult due to many factors, including:

The majority of VARs represent the offerings of multiple companies.

Some companies may compete with their channel on certain opportunities by trying to take the business direct.

The VARs' interests come first. Relationships work best when the manufacturer's offerings align with the VARs' business strategy and expertise. If the VARs' core business is consulting services, they will focus the majority of their sales efforts in this area. For such companies, representing products may be viewed as a way of generating consulting opportunities. Another VAR may want to generate a higher volume of product sales and have little or no appetite for consulting.

VARs representing multiple companies often focus on whatever vendor's offerings are easiest to sell at any given time (i.e., the "hot" product).

The methods used to sell are left almost completely up to the VARs, meaning that manufacturers are ceding the customer experience to individual salespeople who don't work directly for them.

Some VARs have relationships with a relatively fixed group of customers, and may not exert much effort actively pursuing new accounts.

Poor design or execution of channel strategies are common, which - given the circumstances listed above - shouldn't be surprising. Companies establishing indirect channels may fail to realize that in addition to handing over their offerings, they are inadvertently getting into the same business as Customer Focused Selling - that is, providing sales training for their business partners. Most of them are not up to this challenge, with whatever training they provide treating their offerings as nouns.

Applying Customer Focused Principles to Channels

In the same way that many direct salespeople lead with offerings, many channel managers - that is, the people in the organization who are responsible for recruiting and supporting channels - are guilty of taking the same approach. We believe, though, that the principles of Customer Focused Sales can be applied to channels, and we'd like to discuss how the methodology could be used to empower business partners to see how they can increase top-line revenue. We believe that recruiting of VARs can be distilled to business goals, and therefore to conversations.

Calling at high levels is critical when recruiting business partners. The decision to add to or modify the list of companies a reseller represents can cost significant resources and money. The majority of VARs are relatively small organizations. Whenever possible, calling on the owner of the business minimizes red tape, allows early qualification, and shortens the sales cycle. To gain mindshare and be in alignment with the buyer, the initial effort is to convince the business owner that he or she can improve bottom-line results by representing your company and offerings. This is critical when attempting to recruit VARs representing multiple companies. Here is a sample Targeted Conversation menu for the owner of a VAR selling software and services:

Improve margins

Make good technology bets

Improve return on investment of relationships with vendors

Match offerings with their core competencies and customer base

In an initial call, an attempt should be made to cause a business owner who isn't looking to change (the list of companies the business represents) to consider adding your company to the list. (By now, we assume that you recognize much of this language and approach.) We suggest approaching VARs feeling it is necessary to displace an existing vendor on a VAR's list - presumably the one that is making the smallest bottom-line contribution. VAR owners have a finite capacity as relates to the number of manufacturers they can represent. From the VAR's perspective, optimization of these companies will lead to the best bottom-line result. So your job is to demonstrate that your company belongs in that optimized picture.

Examples of characteristics the owner of a VAR could find attractive about a company and its offerings include:

A "hot" market space

A unique offering that few, if any, other vendors have

An offering that is complementary to existing offerings used by their client base

An offering that is a good candidate for add-on business with their customer set

A product with a high degree of accompanying services (SAP, PeopleSoft, and so on) if their focus is on professional services

Attractive margins or commission structure

A channel manager recruiting business partners should attempt to determine which characteristics represent their strengths, and create a menu of potential goals and Success Stories that will most effectively position the company. By doing a diagnosis first, ideally the business owner can be brought to a vision about the benefits of establishing a relationship.

Once you have gotten the attention of an owner who believes he or she can improve business results by joining forces with you, the next step is to provide an idea of how the owner will be successful. Especially for offerings with a mild to high degree of complexity, support of the channels is important. Once again, consider making a list of what you have available to offer partners. Here is a partial list:

Brand recognition

Advertising campaigns and promotions

Education and training for both your partners and their customers

Sales support

Lead generation

Web site or intranet to address frequently asked questions (FAQs)

Marketing programs and support (local and national)

Local technical support

24/7 hotline

Quick turnaround of orders placed

Willingness to offer exclusive territories

In the same way that salespeople tend to spew opinions, many channel managers tell potential partners how great the support is going to be. But many VARs are "burn victims"; they remember that while past relationships sounded attractive while they were being sold, they ultimately turned out to be a series of broken promises and misset expectations. Getting your proposed support down to the level of usage scenarios will be helpful in making sure both parties are on the same page.

Once the buyers believe that they can improve their business results and understand what support will be available, the last area to discuss is the usage of the actual offerings. This will require resources from both parties. As usual, many such recruiting attempts begin with a product "spray and pray." Yes, products ultimately have to come to the fore - but only after you've gained mindshare regarding the value of doing business, and have helped define the support that the partner will need (and that you can provide).

Fixing Broken Channels

In the early stages of a company's existence, recruiting efforts often concentrate more on the quantity than on the quality of channel partners. Eventually, though, quality has to come to the front of the line. Analyses of the contribution of each channel partner tend to show that a 90/10 rule applies. In other words, 90 percent of the revenue is generated by 10 percent of your business partners.

To encourage great VARs and (potentially) motivate poor performers, it is a common practice to establish three or more levels of partners, as defined by revenue thresholds. The designations platinum, gold, and silver have become standard within the technology arena. The higher the designation, the better the treatment, which may include rebates, cooperative marketing funds, higher discounting level, more favorable payment terms, earliest access to new offerings, and so on. Many vendors using indirect channels realize that they could improve their bottom lines if they were able to focus on top-producing partners. Attempting to pare the list can be a delicate situation, though, especially if an underperforming partner was one of the early companies to agree to become a VAR.

Assuming success in recruiting a channel that will provide you with the desired representation in the market, you still face the following challenges when working through indirect representation:

Gaining mindshare about what percentage of resources to allocate to your offerings

Making your offerings easier to sell than other suppliers'

Achieving consistent positioning of your offerings within the marketplace

Qualifying opportunities before allocating resources

Forecasting top-line revenue despite being once removed from the salespeople

Once again, we believe that these and other issues can be addressed by integrating a sales process with Sales-Primed Communications.

Both direct and indirect salespeople display a tendency to follow the path of least resistance. If a vendor can make the offerings easier to sell, with all other things being equal, it stands to reason that resellers will focus a disproportionate amount of effort on that product. Earlier, we discussed the challenge that a salesperson joining a company faces in positioning the offerings of his or her employer. For a VAR representing ten or more companies, the challenge is staggering. It would be virtually impossible for a salesperson to fully understand and develop positioning for more than a handful of offerings. In addition, of course, direct salespeople aren't the only ones who are reluctant or unable - for example - to call on decision makers.

For all of these reasons, and more, we advocate finding ways to give the indirect sales force some (or all) of the same training that the direct sales force receives. The reasons should be clear by now: Once a reseller understands how to execute a Solution Formulator (SF), he or she develops the ability to have conversations with targeted titles within specific vertical segments. We believe that companies providing

Customer Focused Sales training and customized Solution Formulators realize the following advantages:

They make their offerings easier to sell, thereby gaining mindshare.

More consistent positioning is achieved, and the manufacturer can influence the customer experience.

Product training becomes product usage training via SFs and takes considerably less time, effort, and expense. By building Sales-Primed Communications around new announcements, the channel is able to hit the ground running and consistently position those offerings. The prerequisite would be having VAR salespeople master the Customer Focused Sales vision development process.

After a VAR has been trained, there is now a consistent vocabulary and a set of debriefing questions that enable the channel manager to help decide which opportunities are qualified, and therefore worthy of sales support and resources.

If there is a sufficient level of trust that the VAR is providing funnel visibility, the channel manager has a way to more accurately forecast revenue.

If everyone is on the same page, it is easier to segment territories and to intelligently resolve the inevitable channel conflicts, either between VARs or between the VARs and the company they are representing.

Training can be used as a "carrot" for VARs that are producing sufficient revenue - a way to enhance their performance while being subsidized by the manufacturer's cooperative funds. For underachieving partners, it can be used as a "stick" - in that to continue the relationship, they must invest in the training, perhaps on their own nickel.

Custom Sales-Primed Communications for VAR new hires as well as for newly announced offerings can enable VARs to make effective calls with a shorter learning curve.

We believe that organizations successfully implementing Customer Focused Sales can turn the way their salespeople and their VARs' salespeople sell into a competitive advantage. Extending that concept, we believe that Customer Focused Sales can provide companies using indirect channels an advantage that extends far beyond their offerings, margins, advertising campaigns, and so on.

Many companies have chosen to drive revenue through channels without fully understanding how to integrate product training and the sales process. From a senior executive perspective, the allure of lower cost of sales, fewer direct employees, expanded coverage, and so on has often proved hard to resist. But positioning offerings, as we discussed earlier, is well beyond the scope of a traditional salesperson, whether direct or indirect. A compensation plan reflecting a manufacturer's objectives, Sales-Primed Communications, and a repeatable sales process greatly enhances the probability of successfully leveraging channels.