Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 8: Creating Sales-Primed Communications

Overview

Selling at its best consists of a series of conversations with buyers. During these conversations, the salesperson's objective is to uncover and understand the buyer's needs, problems, desires, and goals. As the salesperson learns about the buyer's circumstances, he or she also begins to position the company's offerings. An additional benefit of a competent diagnosis is that the root causes of why the buyer cannot achieve a goal, solve a problem, or satisfy a need are clarified.

Selling organizations would dearly love to influence and steer these conversations. But this seems like an impossibly ambitious and far-reaching objective - so ambitious, in fact, that most such organizations that have considered it have dismissed it out of hand. In this chapter, we lay out a strategy to accomplish that goal.

No, you can't anticipate all potential interactions with buyers at all levels. You can't "boil the ocean," as the saying goes. (And most likely, the salesperson who went in with the boiled ocean crammed into his head would be a poor conversationalist.) So our approach is to help the salesperson orchestrate conversations with targeted decision makers and influencers about specific business issues addressable with their offering. After having such a buyer share a goal, we help the salesperson follow one of a number of flexible scenarios.

Looking at this issue from another perspective, companies that fail to step up to the challenge of influencing sales conversations are abdicating an enormous degree of responsibility to their salespeople. They are asking their salespeople to interpret and communicate the capabilities of their products single-handedly.

So let's begin with the three conditions that must exist in order to have an effective sales conversation about an offering:

The buyer's title (or function) and vertical industry must be known.

The buyer must share a business goal or admit a business problem.

The seller's offerings must have capabilities that a targeted buyer can use to achieve a goal, solve a problem, or satisfy a need - and, of course, the seller must understand and articulate those capabilities.

Given these three conditions, we believe, organizations can help their traditional salespeople have these kinds of sales conversations. They can create Sales-Primed Communications - a way of approaching a conversation that greatly increases the chances of success.

A Caveat

We will return to this premise throughout the remaining chapters, but we want to offer a caveat at this point: The higher within an organization a salesperson calls, the more predictable the conversation. Traditional sales managers will respond well to this observation, of course, since they're always begging their salespeople to shoot higher.

But we're making the same point for a different reason: The higher in the organization you call, the smaller the number of business objectives you are likely to encounter. This sounds a little counterintuitive, but it's not: In general, senior people worry about a finite number of important issues. Conversations with senior management tend to be shorter, more conceptual, and less technical - which in many cases means they're more interesting and more productive.

And looked at from the other end of the telescope: There is a level within every target organization below which people tend to have personal goals or agendas, but these are not usually issues their organizations are willing to fund. Architecting dialogues at these lower levels is nearly impossible. These people may want to learn all about your offerings, but they don't usually have either (1) the title or (2) the business goals. Without these prerequisites, Sales-Primed Communications is impractical.

In the enterprise-solution world, of course, conversations eventually must take place with technical people and end-users. Our concern is when in the sales cycle these meetings take place. If they constitute the initial meeting, brace yourself for a long sales cycle, and one that can fall apart at any one of several places. If, by contrast, your initial conversations are with targeted business people who share with you their goals, your meetings with the people who report to them will be more productive. After having high-level conversations, calls on lower-level buyers can be more focused by having the buyer understand senior management's goals as they relate to the offerings being discussed.

In still other words: We advocate, and are attempting to illustrate, a top-down approach to sales. The structured approach described in this chapter lets salespeople spend far less time with people who can't, or are not going to, buy. Whenever possible, we advocate calls being made on people who can't buy only after qualifying one or more people within the organization who can.

Titles plus Goals Equals Targeted Conversations

We would typically initiate Sales-Primed Communications projects by asking clients a fairly basic question: "What are the typical job titles or job functions of the decision makers and influencers your salespeople will have to have meaningful conversations with?" Or, phrased differently, "Who is in a position to cost-justify, fund, buy, and implement your products and services?"

The first step in answering this is to list your vertical industries. Even if you have horizontal offerings, bear in mind that mainstream-market buyers (as described in earlier chapters) like to feel that the selling organization understands and has done business with their industry.

For each industry, make a list of the titles (or functions) a salesperson is likely to call on in order to get your offering sold, funded, and implemented. This exercise often will be dependent on the size of the potential transaction and the size of the prospect organization. For now, let's concentrate on large transactions to large organizations, since you can scale down this process at any time.

The difficulty of this task is directly related to the complexity of the offering. In some instances, salespeople enjoy the luxury of calling on just one person who can make the decision. For enterprise sales, the challenge ramps exponentially as the number of people and the accompanying number of business issues increase. Having said that, most of our clients find this to be a fairly easy exercise. They can do it from memory, because they encounter the same job titles in sale after sale.

Answering the next questions, though, usually requires more thought: "For each of these job titles, what goals or business objectives should they have in that function? Which of those goals are addressable through the use of your offering?"

Every goal in your list should be a business variable that your company's offering can help a particular title achieve. Ideally, the goal should be monetarily based, as the financial benefit of achieving the goal will be used to determine if the cost of the offering can be justified. Put another way, a business should be willing to spend money to achieve a goal.

Let's imagine that you are selling an enterprise-wide CRM system to a large company. Your amended list might look as follows:

| CEO |

Achieve revenue growth targets |

| CFO |

Improve profitability by lowering cost of sales |

| VP Sales |

Increase revenue through improved win rates |

| VP Marketing |

Increase market share |

| CIO |

Support end-users |

In this example, the objectives of the CIO are especially telling (and this turns out to be true in many cases). Buyers generally need the opportunity to quantify solutions. But how would someone determine, for example, if it would be worth $1 million to better support end-users? The only way to make that business judgment would be to go out and get the perspectives of the end-users - certainly possible, but not an easy task. So the goal that the CIO's office is best able to quantify is that of staying within budget, and that may turn out to be your most fertile ground. Focusing on staying within budget, however, does not bode well for funding new initiatives.

Creating this merged list - job titles with associated goals - sets the stage for what we call Targeted Conversations. But before those conversations can begin, more homework needs to be done.

Next Step: Solution Formulators

As a next step with our clients, we usually begin to develop questioning templates, which we call Solution Formulators, or SFs.

We recommend that Marketing take responsibility for developing these materials and maintaining them. They represent the core content of a company's Sales-Primed Communications, and they give selling organizations the ability to influence the conversations that their salespeople have with buyers. Simply put, they constitute a sort of road map for a salesperson - a tool that he or she can use to lead a specific job title to a specific vision of using the company's offering to achieve a specific goal.

Unlike a movie, where the writer and director exert full control over the interactions among the actors, no dialogue between a buyer and seller will go absolutely according to a script or a plan. Instead, our approach is about increasing the odds in the salesperson's favor by setting the stage for a Targeted Conversation. If a seller can approach a call with a clear idea of (1) who he or she is talking to and (2) where he or she hopes the conversation will wind up, the chances improve. On average, the seller will make better calls.[1]

Solution Formulators, as noted, are the core content of a company's Sales-Primed Communications. So it may surprise you to learn that the messaging in SFs takes the form of questions. Why? Because questions keep salespeople from "telling." As long as they are asking intelligent questions that their buyer is capable of answering, they are not selling (at least in the buyer's mind). They are consulting. This is a welcome change for the buyer, and also for the seller.

We believe the role of the salesperson is to become a buying facilitator by leading the buyer with questions that are biased toward their particular offering. SFs help develop "buyer visions" that have a bias in favor of your offering.

Some people have difficulty with the term bias, feeling that it implies a manipulation of the buyer. We disagree. When we talk about creating a bias, we mean that the salesperson should be making an attempt to help the buyer put his or her stated goal in a context in which the seller's offering will help the buyer achieve that goal. It's something analogous to trying on a new pair of running shoes to solve the problem of recurring blisters. If the shoe fits, great. If the seller's offering doesn't fit the problem as defined by the user, then the "opportunity" should be disqualified.

Here's another analogy: Let's say you injured your back, and you consulted with three doctors - one trained in the United States, another in China, and a third in Sweden. Most likely, their methods of treating you would vary enormously, based on their training and experience. And most likely, each would attempt to create in you a bias in favor of his or her specific therapies. Are they manipulating you? No. They are offering solutions based on how they have been successful in treating similar conditions in the past. They are attempting to help you solve your problem (very patient-focused). And ultimately, you will choose your doctor based on the trust and confidence the doctor created during the diagnosis.

Once you have created your Targeted Conversations List for a given offering, you are ready to create Sales-Primed Communications, in the form of SFs. You do this by assembling four components: offering, industry, title, and goal. Using an example from the list developed above, the result would look like the following:

Offering: |

CRM Software |

Industry: |

Fortune 1000 Company |

Title: |

CFO |

Goal: |

Improve forecasting accuracy |

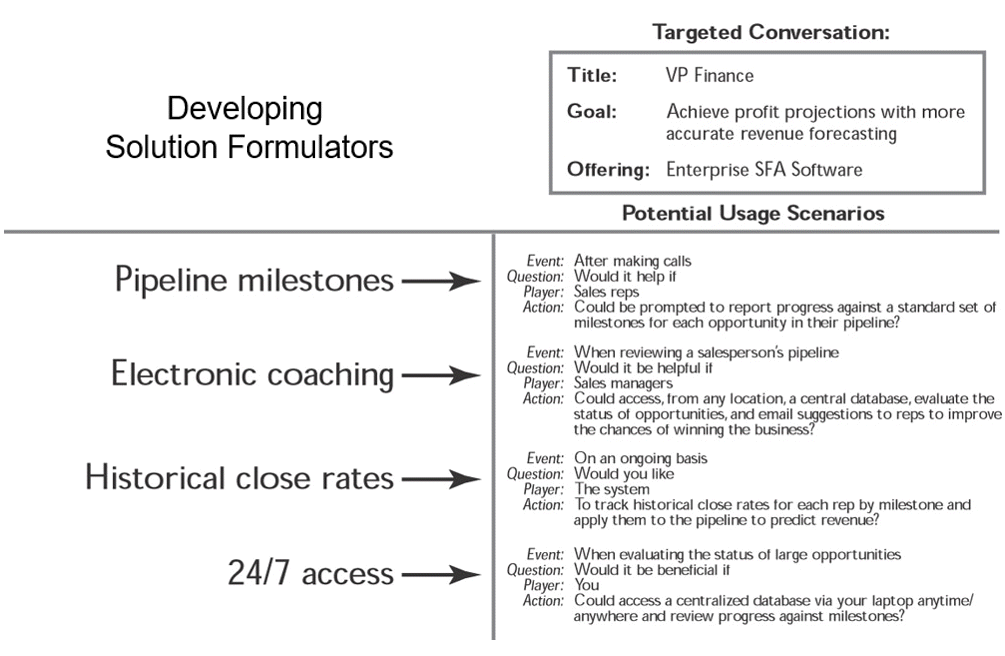

The next step is to position your offerings. With the CFO's goal of improving forecasting accuracy in mind, you now identify all the features of your CRM software that could be used to achieve this goal. As you do so, keep in mind that up at the CFO's 30,000-foot level, multiple features are likely to merge into one overarching feature, and / or that there may be features that are vital to users but will be of no interest to a senior executive. We recommend distilling your features down to your top four.

That said, here is an example, with the features that could be helpful to a CFO wanting to improve forecasting accuracy highlighted in italic type:

Password administration

Single view across platforms

24/7 access

Contact information

Account history

Cross selling

Standard milestones

Political mapping

Electronic coaching

Historical close rates

Lead tracking

Passing of leads

Analysis of past campaigns

And so on, ad nauseam

This may seem like a small step, but we believe it is a significant one. It is the start of positioning the CRM offering in a way that is targeted on a specific conversation - and is being done on behalf of the salesperson. In the same way that a tailor takes a client's measurements prior to an initial fitting, this is an attempt to put some structure around the prospective conversation by identifying the parts of the CRM offering most likely to be relevant to a CFO who wants to improve forecasting accuracy.

Nearly as important are the features not chosen for a potential conversation. They have been eliminated because they have little potential relevance to the topic of forecasting accuracy. Note, too, that they probably are not of interest to a CFO under most conceivable circumstances. Discussing them with a CFO is likely to confuse the buyer, waste time, and / or cause a seller to be delegated to a lower level. Even though this exercise so far has done executive buyers of the world a tremendous service, there is still work to be done.

Back to the Usage Scenario

A problem remains. If a salesperson simply blurted out "24/7 access!" to a CFO, that probably wouldn't be successful. Most likely, the phrase would mean more to the seller than to the buyer. Feature names (nouns) don't help buyers understand how the features can or could be used (verbs). Therefore, an additional step is needed to convert features into usage scenarios, as introduced in the previous chapter. Here again there are four components:

Event: The circumstance causing a need for the specific feature.

Question: Asking versus telling doesn't feel like selling to the buyer.

Player: Who (or what system) will take action to respond to the event.

Action: How the feature can be used, stated in terms buyers can understand and relate to their job title. The description of the action should be specific enough so buyers can visualize how the result will be achieved. Terms used in a call with a CIO, for example, would be different from those used when calling on a CFO.

Let's take a closer look at the feature 24/7 access to create a usage scenario for a conversation with a CFO about the goal of improving forecasting accuracy:

Event: When trying to determine the status of large opportunities,

Question: Would it be helpful if

Player: You

Action: Could access your pipeline via a laptop, anytime, anywhere, and review progress against standard milestones, without needing to talk with anyone in your sales organization?

Please note that the action refers to the ability to "access pipeline information via a laptop." This degree of specificity and concreteness is deliberate. If it simply read, "could review progress against milestones without needing to talk with anyone in your sales organization," the CFO probably would have no way of understanding how this would be accomplished.

In other words, the salesperson would be asking the CFO to either (1) imagine how it might work or (2) trust that it would work. But buyers - especially those who have authorized previous expenditures that haven't performed as advertised - are likely to be very skeptical. (They will be short on imagination and trust.) And keep in mind that we want all buyers to be able to articulate what they are buying and why, if asked by another person within their organization to explain the offering. "I can use my laptop to access specific opportunities in the pipeline even when I am on the road," the empowered buyer can say with confidence.

Here are the other three features selected for a discussion with a CFO about forecasting accuracy that have been converted to usage-scenario format:

Event: After making calls,

Question: Would you like

Player: Your salespeople

Action: To be prompted on their laptops to report progress against a standard set of milestones for each opportunity in their pipeline?

Event: On demand from any location,

Question: Would it be helpful if

Player: Your sales managers

Action: Could access the pipeline database for their salespeople, evaluate the status of specific opportunities, and email suggestions to reps to improve their chances of winning the business?

Event: On an ongoing basis,

Question: Would it be useful to you if

Player: The system

Action: Could track historical close rates for each salesperson by pipeline milestone, and apply them to each of the salesperson's opportunities to predict revenue?

The next step would be to sequence these usage scenarios. This is usually driven by the order in which the buyer would be likely to encounter them. In this example, you want to lead the CFO to a vision of creating an accurate monthly forecast. The right sequence, therefore, is: pipeline milestones, electronic coaching, historical close rates, and 24/7 access.

Note that the feature we considered first - 24/7 access - winds up being the last in the sequence. This kind of reshuffling is quite common, and illustrates the importance of approaching this task systematically.

The Templates

Let's formalize this template - in part to emphasize that salespeople need structure for using Sales-Primed Communications to make calls, and in part to underscore the systematic nature of our approach.

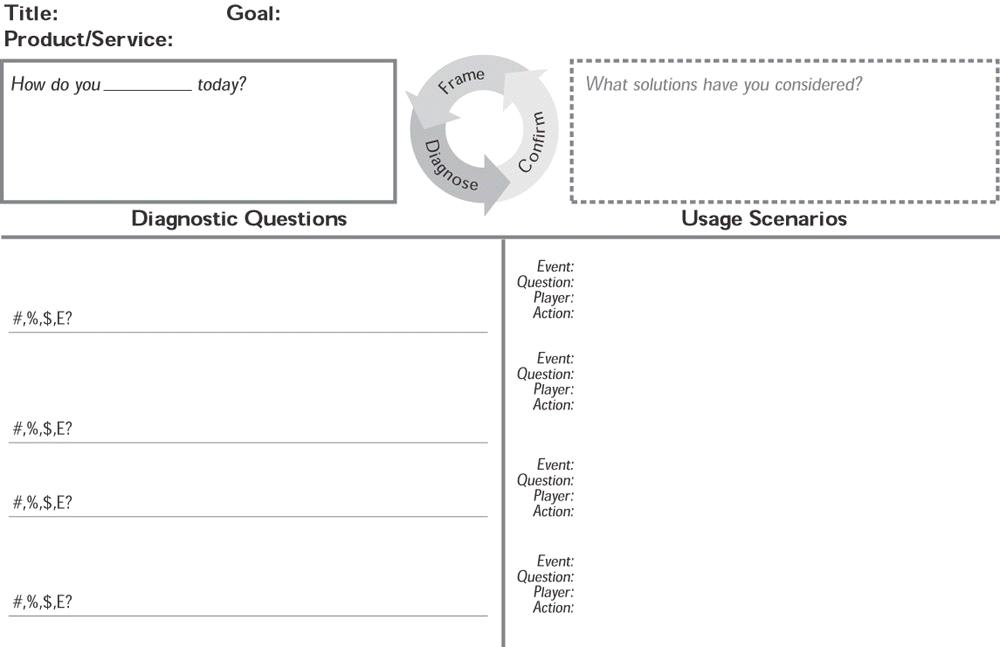

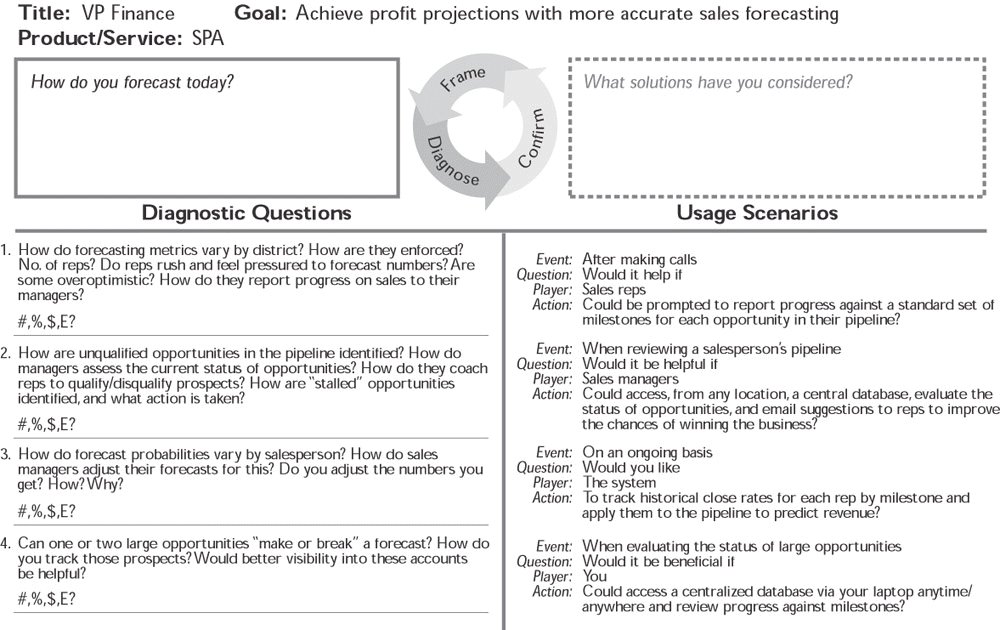

The header information in the blank Solution Formulator (SF) template (Figure 8-1) contains the prerequisites for the targeted sales conversation (offering, vertical industry, title, goal). Figure 8-2 shows the partially developed SF that we are building for the CFO of a software company whose goal is improving forecasting accuracy. The right column has been populated with the usage scenarios we developed earlier that were relevant to the buyer's goal.

Figure 8-1: Solution Formulator Template

Figure 8-2: Solution Formulator-in-Progress

But what's that column labeled "Diagnostic Questions" on the left of Figure 8-2? We have just created four usage scenarios that might be used to enable a CFO to visualize how he or she could improve forecasting accuracy. But the real test for this system comes when a salesperson tries to determine which of these usage scenarios a CFO would agree he or she needed, during a structured conversation. Consider how important the diagnostic process would have been in the selection of a doctor earlier in this chapter. In sales, since the diagnosis is so critical, does it make sense to abdicate this step to traditional salespeople?

For each usage scenario, therefore, we now create corresponding best practice diagnostic questions for the salesperson to ask in order to determine if the buyer has a need for the usage scenario described in the "event, question, player, action" (EQPA) question. In addition, it is helpful to seed questions that can be used to determine the potential value of a usage scenario to the buyer.

Diagnostic questions are used to better understand how the buyer is performing a function today - e.g., forecasting - and, ideally, the cost of doing it the way he or she is currently doing it. At the same time, good diagnostic questions help the seller build credibility, in the same way that a physician you meet for the first time builds credibility with you by asking insightful, intelligent questions that you are capable of answering

Now refer to Figure 8-3. This fills in the Diagnostic Questions column with the questions that a competent diagnostician would ask a buyer. (Remember: These are good questions only if the person with whom you're having the conversation can answer them - the point is not to embarrass someone with unanswerable questions.) Every conversation is different, and no conversation would follow the script outlined in Sections 1, 2, 3, and 4. Conversations have to follow their own flow; otherwise, they're not conversations. But if you look at these questions, you'll get the idea.

Figure 8-3: Solution Formulator Example

How many usage scenarios will a given CFO want to engage? The answer lies between zero and four. (Zero means you're not calling on a qualified buyer as relates to forecasting accuracy; four approaches the upper limit that can be dealt with in a conversation that's scheduled for a half-hour.) Later, we'll describe a structured way for salespeople to navigate through SFs so they can lead the buyer to understand why he or she is having difficulty achieving a goal (diagnostic questions) and what is needed to achieve the goal (usage-scenario questions).

So we've now completed the first SF. Additional SFs would be created for each remaining goal on the menu for CFOs. After that, this same process would be repeated for each title/menu that is specific to an offering and vertical title. The final result is Sales-Primed Communications to enable sellers to have targeted conversations with the titles needed to sell, fund, and implement an enterprise CRM system.

Closing Observations

Is this a significant effort? Absolutely. But we believe the result is well worth that effort. If properly prepared, SFs provide a more consistent positioning of offerings by all salespeople, and should help your sales effort overall.

A few other observations about creating SFs:

They get easier to prepare after you have created the initial ones, because usage scenarios tend to be reusable for multiple targeted conversations.

While Marketing should take responsibility for the creation and maintenance of SFs, it also requires significant involvement from the sales organization.

The true test of an SF is whether it can be used in making a call. If it cannot, salespeople must offer constructive feedback on how it needs to be modified.

At executive levels, anticipate that a salesperson has only 15 to 20 minutes to have a discussion. This means limiting the number of usage scenarios to a maximum of four (perhaps with a fifth in reserve).

A single usage scenario may require integration of multiple product features.

SFs are indexed by vertical market, title, and business goals and objectives. Therefore, they are geared more toward management discussions than toward product presentations. If you are selling a complex offering with 847 features, eventually someone in the organization will want to know about all of them - and maybe more - in discussing potential future enhancements. SFs won't be useful in these calls, which are often associated with due diligence.

But we'd turn this on its head by asking a key question: "Where in the buying cycle are these detailed feature discussions taking place?" If they are during the first meetings in an enterprise sale, it may take months of effort to get in front of the right person. It is far better to have these "due diligence" meetings take place after you have generated interest at business/executive levels.

Whenever possible, SFs should bias buyers toward usage scenarios that represent a company's strengths against competitors that either (1) are in the account today or (2) are likely to be invited to compete at a later time.

SFs should be developed for offerings besides product. As an example, software companies should create templates for selling professional services and ongoing consulting. We work with a company selling copiers and printers that has an SF for positioning leasing (which is more lucrative for them than a straight purchase).

In the same way that your marketplace and offerings change, SFs are dynamic, not static, and must be maintained and updated over time. Sales-Primed Communications is more a journey than a destination.

New product or service announcements should be accompanied by (even preceded by) the preparation of SFs.

Outside help may be necessary, in preparing SFs. Many people working for a company get so steeped in their offerings that they find it hard to create SFs; conversely, people unfamiliar with a company's offerings often have an easier time of it. If the ultimate objective is to facilitate a dialogue with an executive who is unfamiliar with your offerings, you may find that hiring an outside person to pick the brains of your smartest people is a good investment.

With salespeople directed to higher levels, qualification becomes easier. Most senior executives will not waste their time or their staffs' time. If they point or delegate you to others after being empowered to achieve a goal, they are serious about evaluating your offering.

Some of our clients find that in calling high, SFs can span multiple offerings. This is a shift from selling product by product at lower levels. In some cases a single usage scenario at a decision-maker level can cover an entire offering. The call on the next level down may consist of an entirely separate SF to have a more detailed discussion.

In creating SFs, it is sometimes impossible to establish competitive differentiators. Consider for a moment multiple vendors selling CRM systems. To make it easier, let's assume all offer client-server applications. If salespeople are making calls at the highest levels (CEO, CFO) and having conceptual discussions, the conversations (and therefore the SFs for any such CRM company) would be similar. Differentiators may have to be introduced at slightly lower levels.

[1]The phrase "better calls" involves a subjective judgment, but in Chapter 12 - Qualifying Buyers, we'll show you a more objective way to debrief and assess calls.