Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 12: Qualifying Buyers

Overview

Many organizations have great difficulty forecasting top-line revenues. We believe that this reflects an underlying problem: Pipelines are full of unqualified buyers. Most organizations have no standard way of accurately assessing which prospects are likely to buy.

Our strong sense - as will become clear below - is that the sales manager should disqualify buyers, based on the best available correspondence between the salesperson and the prospect. The alternative is to abdicate this responsibility to individual salespeople, which almost inevitably leads to unqualified buyers being in the pipeline, resulting in inflated top-line revenue estimates. So how do the sales manager and the salesperson work together to qualify buyers, build pipeline, and develop more accurate forecasts?

A prerequisite is to agree on a standard set of terms describing the Key Players involved in making buying decisions. This facilitates qualifying multiple Key Players who play different roles in a given opportunity. A prospect with all roles filled is a better bet at forecasting time.

We define Key Players as being those individuals whom a seller must access in order to sell, fund, and implement the offering. As you would expect, the number of Key Players is proportional to the size and complexity of what is being sold. Here are our definitions of the Key Players:

Coaches want the seller to win the business, and are willing to provide information and do inside selling. They have only limited authority within the organization, but they can serve as the eyes and ears for a salesperson as an opportunity develops.

Champions provide access to Key Players, as requested by the salesperson, and can be found at any level within the prospect organization. Generally speaking, the higher within the organization your Champion, the better your chances of success and the shorter the sales cycle. The ideal situation is to have your Champion also be the decision maker. In such cases, the buyer will often volunteer access to other Key Players even before the salesperson asks for that access, and this access will be to people below him or her in the organization - a good thing. While bottom-up access is necessary at times, the first choice is top-down.

Decision makers can make the vendor selection and cause unbudgeted funds to be spent, which (as explained in earlier chapters) is critical if a seller initiates a buying cycle in an organization that wasn't looking to change, and therefore had no budget for change. In addition, a decision maker can commit internal resources to evaluate a salesperson's offerings. In the case of purchases by committees, there can be multiple decision makers.

Financial approvers are the people who must sign off on expenditures. Their role can range from being passive (rubber stamp) to being an active and involved player in the decision process. Gaining financial approval is easier when this person understands the value of addressing the goals the organization wants to achieve.

Users and managers of users are people involved in using the offering. For implementations affecting a wide group of people within an organization, supportive and enthusiastic users can be critical to a seller's success. Users can help sales campaigns by providing a groundswell of support. (Conversely, their reluctance or skepticism can scuttle an otherwise viable opportunity.) Users don't usually have business goals. Their concerns are more personal: They want to decide if the offering will improve their stock in their company and simplify or complicate their lives. It's rarely possible for a seller to interface with all potential users, but getting (at least) some opinion leaders on board - including, for example, managers of users - can be a critical step in making the sale.

Implementers are the people responsible for migrating from the current method to the new offering. Often their major concern is not a corporate objective. They will be measured on their ability to integrate the new offering on schedule and under budget. They prefer doing business with vendors that offer professional services and ongoing support.

Adversaries are individuals who either don't want to change, want to control change internally, or want to do business with a competitor. They can include, for example, Champions for a competitor, individuals whose power is derived from the current method of doing things, IT staff members who want to develop the desired capability internally, and so on.

In our experience, salespeople tend to avoid their Adversaries, which is generally a mistake. A salesperson's objective should be to convert, neutralize, or eliminate Adversaries. Of course, this needs to be done carefully. For example, a one-on-one meeting can be confrontational, and can further polarize opposing positions. Instead, we suggest including people who are on your side when you meet with Adversaries - preferably, a proponent who outranks your Adversary.

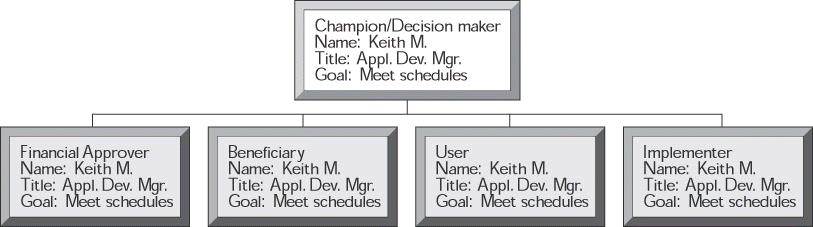

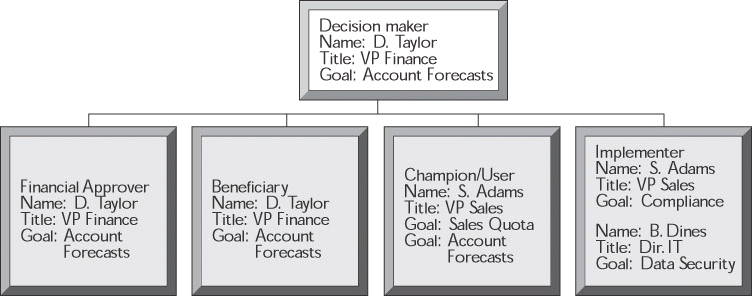

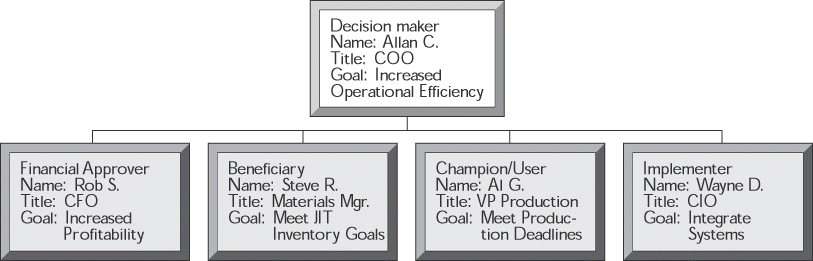

These definitions of members of the buying committee become the basis for discussing and developing strategies for specific opportunities. Look at Figures 12-1, 12-2, and 12-3. In these charts, we've laid out three different sized opportunities and identified the Key Players and their associated titles and goals. (Note that there are occasions where a Key Player plays more than one role.) Also note the emphasis on goals: the starting point of all Customer Focused Sales.

Figure 12-1: Opportunity Organization Chart: Middleware Opportunity - $50,000

Figure 12-2: Opportunity Organization Chart: Sales Process Automation - $500,000

Figure 12-3: Opportunity Organization Chart: ERP Deployment - $3 Million

This may look like a lot of extra work. But given a simple organizational chart software package and a little practice, it should prove relatively easy. And in our experience, understanding, preparing, and updating simple charts like this helps both the salesperson and the sales manager, as they work together to qualify opportunities.

Qualifying a Champion

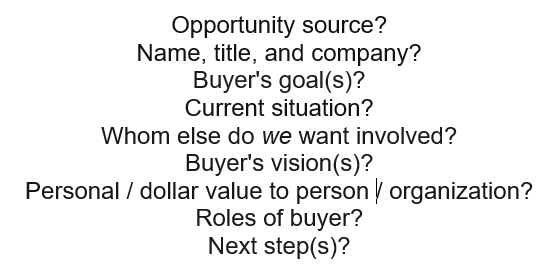

One key element in the qualification process is to identify and reinforce a Champion. When the salesperson is calling high, the Champion will often be self-nominating. He or she will often volunteer access to Key Players. More often, of course, he or she has to be asked through the kinds of Customer Focused Sales correspondence with buyers. After a call on a potential Champion, the salesperson should be required to answer the debriefing questions in Figure 12-4.

Figure 12-4: Sales Call Debrief Questions

Once the answers to the debriefing questions have been edited and approved, the seller now composes a Champion Letter. The Champion Letter or email serves four important roles:

It provides a sanity check for salespeople to verify that they have articulated the buyer's goal, current situation, and vision.

After sellers demonstrate mastery of this process, sales managers can allow the Champion Letter to be sent without being edited. In such cases, it allows the manager to audit a salesperson's achievement of milestones to see if a prospect is worthy to be in the pipeline. Any process must have an audit trail, and, assuming that salespeople create visions using Solution Formulators, all of the debriefing questions contained in the Champion Letter must be answered.

It serves as a reminder to the buyer of the conversation with the salesperson. Unlike vendor brochures, this letter minimizes the chance of the buyer becoming confused if he or she is evaluating offerings from other companies.

It facilitates internal selling by providing prospect-ready messaging (the words for your Champion to use to explain or defend his or her interest). For this reason, many salespeople prefer to email the Champion Letter on the day of the call, and follow up via physical mail. Our preference is email, which can be forwarded easily to Key Players.

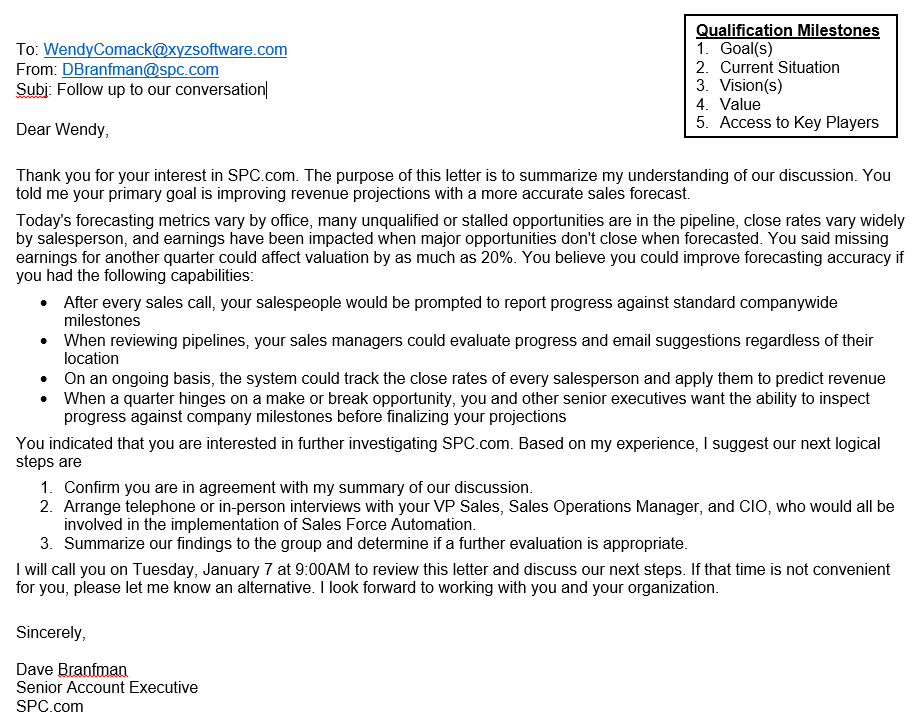

We include a sample Champion Letter in Figure 12-5. We believe that the sales manager should be involved in writing, or at least editing, Champion Letters until he or she is confident that the salesperson can accomplish this without help. Having a half dozen good models in the drawer should build that confidence in both parties.

Figure 12-5: Sell Cycle Control Champion Letter (Email): Qualifying the Buyer

Take a minute to read the first three paragraphs of our sample letter. Here's where the goals, current situation, vision, and value for the Champion are summarized. (The insert in the upper right-hand corner is not included in a real Champion Letter.) Please note that all answers to the debriefing questions come from executing the Customer Focused Sales process. Traditional salespeople need both a map (milestones) and explicit directions (a defined sales process plus Sales-Primed Communications).

In previous chapters, we've hammered away at the importance of consistency in messaging. What many organizations fail to realize is that a great deal of selling occurs while the salesperson is not present at the prospect organization. How? After a successful sales call, many buyers attempt to share their excitement with other people within the organization. In fact, the better the call, the more likely this is to happen.

But how confident are you that your message will get across accurately? Consider how long it takes a salesperson to become proficient at relating the offerings in a way that makes sense to the many different buyers he or she calls on. Most likely, this is an intensive, full-time effort over several months. How well prepared is a buyer who spent 45 minutes with a salesperson to recreate the excitement the buyer felt about a vision of using the offering to finally achieve a goal or solve a problem?

Take an example from everyday life. You attend a professional meeting, and the after-dinner attraction is an inspirational speaker (who most likely has practiced and delivered this same talk many, many times over the previous months or years). You are carried away by the speaker and the subject, and - on returning home - you attempt to convey your excitement to your spouse. Hard to do, right? Most likely, it's one of those "you had to be there" situations, and you may find that your enthusiasm is now muted. Maybe that speaker wasn't that good, after all. . . .

So messaging is important in your correspondence from the very first encounter with a potential Champion. Give the Champion the scripts he or she needs in order to serve as your surrogate.

Now look at the fourth paragraph of our sample letter, which begins, "You indicated that you are interested. . . ." One of the trickier and more important building blocks of the Champion Letter comes toward the end, where the salesperson attempts to shape the further investigation of the opportunity. This is where the salesperson attempts to get the Champion to agree to provide the salesperson with access to Key Players. Which Key Players? The titles will vary, depending on the complexity of the offering, how many people will be affected during the implementation, the size of the proposed expenditure, and the size of the target organization. Another variable may be the state of the economy. During difficult financial conditions, even add-on business with existing customers may require more sign-offs, and at higher levels, than previous orders. A rule of thumb is to review your Targeted Conversations List.

For these reasons, the sales manager should be involved in these decisions, at least until the salesperson has demonstrated the ability to make these kinds of determinations. The sales manager should not hesitate to get reinvolved in these decisions if circumstances change, either on the seller's end or on the buyer's end.

This approach - requesting access to Key Players in the Champion Letter - relieves the seller of the burden of having to request access during a call. At the same time, though, it ensures that this critical step is actually taken. Some traditional salespeople are primarily concerned about getting and keeping opportunities in their pipelines, and are therefore hesitant to ask tough qualification questions. This isn't acceptable: An opportunity isn't real until access to the entire buying committee has been granted and documented, which leads us to the next step.

Following Up on the Champion Letter

Once the Champion Letter has been sent, the salesperson needs to follow up on that communication in order to get the buyer's agreement to the following points:

The letter accurately summarizes the conversation(s).

The buyer is willing and able to provide access to the requested titles.

After interviewing all Key Players, there will be a chance to gain consensus that further evaluation is warranted.

Once the salesperson has verified these points and can produce the Champion Letter, the sales manager can now grade this prospect as a C. As we'll emphasize again later, sales management should perform grading of pipeline - and forecasting in general. It should not be the responsibility of salespeople, who historically are optimistic and are motivated by their desire to have their manager believe that everything is O.K. within their pipelines, regardless of the actual condition of those pipelines.

There will be times when the follow-up call to verify the contents of the Champion Letter will not go according to plan. (If it always did, there would be less reason to write Champion Letters.) Buyer "push back" or disagreement must be resolved if the prospect is to be considered viable.

The buyer may question or dispute the contents of the letter, in which case a discussion is necessary to clarify issues. If the discussion succeeds, the Champion Letter should be modified to reflect whatever changes are necessary. The seller qualifies a Champion after obtaining the buyer's acceptance of the revised letter.

Sometimes the salesperson's request for access to Key Players may be challenged or denied. In the following paragraphs, we present the most common reasons why access is denied - at least initially - and suggest ways to handle them.

The buyers indicate that they will sell it internally. This reluctance may be an indicator that you are Column B (vying for a silver medal), especially if the buyer is the one who initiated the contact. The prospect may have been instructed to get pricing, but not grant access to others. Or, alternatively, buyers may simply want to maintain control and get all the credit for introducing the concept to others. In our experience, any one of these conditions dramatically reduces your chances of success in both selling and forecasting.

We suggest making it clear that your Champion is welcome to accompany you on meetings with Key Players whenever he or she feels it is appropriate. This may help to address the issue of the person's wanting to maintain control and exposure. We have also found it effective to make the (accurate) point that you and the prospect have spent only a brief period discussing your offerings, and that it is unfair to place the burden of selling the offering internally on his or her shoulders.

The buyers say that Key Players' involvement is unnecessary. In these cases, the salesperson can and should point to potential implementation issues if everyone is not on board from the outset. Another option is to indicate that unless Key Players are aware of an evaluation, both the prospect and the salesperson may wind up spinning their wheels by undertaking an unsanctioned initiative.

The buyer is skeptical, and indicates that it is too early to involve other people. Depending on the complexity of your offering, this may be a valid concern. Up to this point, you (most likely) have had only a conversation or two with the potential Champion about your offerings. Perhaps this is the juncture to offer a proof session or demonstration with a fairly straightforward quid pro quo: "If the proof satisfies you, then will you get me access to the specified Key Players?"

When attempting to get access to Key Players, the salesperson should be politely persistent. This is important. It simply can't be sidestepped. Failure to have conversations with these people leaves the salesperson and company vulnerable to long sales cycles, no decision, silver medal competitions, and other bad things.

If access is not forthcoming, it is important to figure out what's really going on: Is the Champion unable to provide access, or unwilling? If a prospect is unable to obtain access to decision makers, the salesperson needs to ask who could provide that access. If a prospect persists in being unwilling to grant access, the sales manager should be involved in making the decision as to whether or not to keep competing for the sale.

Qualifying Key Players

Once a Champion agrees to provide access to Key Players, phone conversations or face-to-face sales calls should be scheduled. Ideally, the Champion and the seller together should strategize the sequence of these calls. Often a Champion can prepare a Key Player for a call, and - in some cases - the Champion may want to accompany the seller on certain calls. These meetings tend to yield more favorable outcomes if your Champion has copied Key Players on your correspondence. When a Champion identifies a potential Adversary, we suggest calling on that person last and asking the Champion to participate.

The good news is that calls on Key Players may be less challenging than initial calls on potential Champions, because a few hurdles have already been passed. Key Players may have a sense that incompetent or insincere salespeople would not have been granted access. In fact, the chances of successful Key Player calls are often influenced by the power your Champion wields within the organization.

The objective in decision maker and Key Players calls is to briefly introduce yourself and your organization, summarize the previous calls made within the account, give the buyer an opportunity to share his or her goals, diagnose each, create visions, and establish value. For these reasons, preparation is vitally important. Great preparation will keep you out of a number of traps. For example, there are some stereotypical "salesy" behaviors that can lead buyers to draw unfavorable conclusions about a salesperson they are meeting for the first time. Part of your job, therefore, is to demonstrate to the buyer that you don't conform to the stereotype of traditional salespeople.

Again, great preparation helps. We suggest that you arrive prepared with a "call introduction," a summary of the meetings within the account to date (goals, current situation, visions), and a menu of potential goals, Success Stories, and corresponding Solution Formulators for each potential goal of the title that is being called on.

Salespeople must develop the call introduction in their own words, but it should be concise and fact-based (rather than opinion-based). Here is an example of a call introduction - typically delivered after introductions have been made and a certain level of rapport has been established.

Today I'd like to briefly introduce XYZ Company, summarize meetings I've had with other members of your organization, discuss your objectives, and mutually determine if there are areas where our offering would have value for you.

XYZ Company enables organizations to use our offerings to reduce engineering design cycles, thereby shortening time to market. We were founded in 1995, and last year achieved $95 million in revenue. Some of our clients include Boeing, Hewlett-Packard, and IBM.

I was introduced to your company by Larry Furth, your VP of Production. He would like to reduce scrap (goal) by having the number of late engineering changes reduced. I also met with Kevin Hile, your VP of Engineering, who indicated that he wants to reduce engineering design cycles and reduce recalls due to product defects (goals). That gets you up to date with the meetings I've had so far. Perhaps you can tell me, in your role as CFO, what are you hoping to accomplish?

At this point, as in the conclusion of the telephone-prospecting script, your objective is to have the buyer share at least one specific business goal for which you have a prompter. (To get a sense of how to handle the possible responses, review the previous chapter.) In calling on a Key Player, however, keep in mind that another situation may arise. Sometimes senior executives merely want to meet the salesperson and understand the conversations that have gone on to date. Since they are able to connect the dots on their own, they may not necessarily need to share a goal during the meeting.

In the example cited above, once the CFO understands that his staff believes they can reduce scrap, shorten engineering design cycles, and minimize recalls, that may be sufficient for the salesperson to win the CFO's support for the project. It's almost always worth asking, "What are you hoping to accomplish?" But if the question doesn't elicit a goal, don't push it. A sensible next step is to tell a Success Story and / or offer a menu of goals for the CFO. If there still is no positive response, the salesperson should engineer a polite exit. This entails thanking the CFO for the opportunity to apprise him or her of progress to date, informing the CFO that a meeting will be held after all Key Players have been interviewed to gain consensus to proceed with the evaluation of the offering, and inviting the CFO to participate in that meeting.

As early as possible in the buying cycle, as implied in the above scenario, the salesperson should conduct meetings with all Key Players. This accomplishes several objectives:

Everyone understands the potential benefit to him- or herself and the organization.

Getting everyone involved can often result in larger payback and therefore justify potentially larger transactions.

Having multiple points of contact in the organization means that you may not have to start all over if one person gets fired, is promoted, leaves the company, or dies.

If there is a strong Adversary, he or she will be identified fairly early. If the Adversary is powerful and can't be neutralized, the salesperson (in concert with the sales manager) may decide to withdraw rather than go the distance and lose, bringing only a silver medal back to the office.

Again, this is a reality check. It is highly unlikely that a prospect will grant these interviews to anyone who doesn't represent Column A.

Like the Champion call, these calls on Key Players should be documented. Whenever a new goal is shared, the equivalent of a Champion Letter should be generated, although the request for access to Key Players should be eliminated.

Qualifying RFPs

We touched on the subject of RFPs (Requests for Proposal) in Chapter 5. Sellers also receive RFQs (Requests for Quotation) and RFIs (Requests for Information).We'll refer to them collectively here as RFPs.

RFPs represent a particular challenge when it comes to qualifying buyers. As also noted, they tend to come in two flavors:

Those that you "wired" because you were Column A

Those that someone else occupying Column A wired, and for which you are being asked to serve as a silver medalist

Yes, there will an occasional "stray bullet" where the sender of the RFP doesn't know the requirements, and therefore has not established a favored vendor. We find these to be rare, and they most often turn out to be fishing expeditions - either for companies to discover what is available out in the market, or for their IT department to receive free education in order to generate specifications for in-house projects. We have found that many of these situations turn into long sales cycles, with a high probability of no decision being made.

By their nature, RFPs slow down the buying process. They are more common among mainstream-market buyers. Companies use several justifications to defend the time and effort involved in issuing RFPs:

Companies find out what offerings are available.

Vendors talk about one another, allowing a more informed choice.

Companies meet due-diligence requirements.

Companies get free advice/consulting.

Companies can make an assessment of vendor submissiveness.

Vendors bid against one another.

Companies give the appearance of being fair to all vendors.

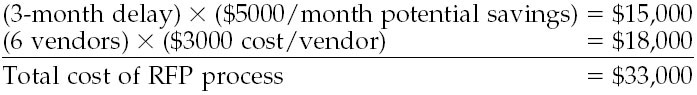

As an aside, many organizations talk long and loud about their cost of sales. Amazingly, though, few calculate what it actually costs to generate and monitor RFPs with multiple vendors. Consider an organization that issues an RFP to six vendors, with the intent of stirring up a price war, for a $75,000 transaction that has the potential to allow them to save $5000 per month. Conservatively speaking, the time to generate, publish, distribute, and provide adequate time for vendors to respond to the RFP will add 90 days to the process. Let's also assume a cost in labor-hours of $3000 for the resources required to interact with six vendors (again, that's conservative). Without regard for the time and effort needed to actually write the RFP, which may involve expensive talent, here is an estimate of the imbedded costs:

Based on these figures, the RFP must enable the issuing company to negotiate a $42,000 ($75,000–$33,000) price with the gold medalist just to break even.

Having looked at this from the side of issuing organizations, let's consider a vendor's perspective. Over the past 12 months, how many RFPs has your company responded to where you were reactive rather than proactive (meaning, you were surprised when you received the document)? Now estimate your win rate on those "opportunities." If that figure is acceptable, feel free to skip the next few paragraphs.

We worked with a client that had an entire department whose sole responsibility was responding to RFPs. The average response took 80 labor-hours - and the company's 145 responses to unsolicited RFPs over the previous 12 months had resulted in precisely three wins. Perhaps your win rate on unsolicited RFPs is better than 2 percent. (We hope so.) But it's probably not satisfactory. The hard fact is that if you play by rules that have been prewired by your competitor, more often than not you will be receiving a silver medal. On analysis, most companies discover that responding to RFPs wired by other vendors is an unprofitable practice.

So let us propose a qualifying alternative.

When issuing an RFP, organizations want something from vendors: namely, a column (either A or - more likely - something east of A) on the spreadsheet. We suggest that you offer a column in exchange for access to a Key Player. If the organization issuing the RFP won't give you access, this is a clear signal that the relationship will end unhappily for you.

The message, whether an opportunity is discovered proactively or reactively, is to scrub the input into your pipeline. Sales managers (unless they choose to make an exception) should require documented access to Key Players before authorizing the resources needed to compete. Would you prefer gold or silver?

In the next chapter, we look at the challenge of managing a sequence of events across the life span of a sale - the selling organization's equivalent of project management.