Westside Toastmasters is located in Los Angeles and Santa Monica, California

Chapter 11: Developing Buyer Vision through Sales-Primed Communications

Overview

In previous chapters, we've emphasized the importance of getting to the point where a buyer has either shared a goal or admitted a problem that the Customer-Focused salesperson's offering can help them address. This is a watershed event, in that it starts a buying cycle. Buying cycles end in one of two ways:

A decision is made to buy - either from you or from another sales organization.

Buyers decide not to buy. The most common reasons buyers don't buy are that they conclude the proposed offering is too risky or complicated, it can't be cost-justified, or their priorities shift. The phenomenon of "no decision" is more common with mainstream-market than with early-market buyers.

The sharing of a goal makes a salesperson's job significantly easier, because the buyer now sees potential value in improving one or more business variables. This can create a sense of urgency, depending on how much potential improvement can be achieved. Sellers are usually trying to push sales cycles ahead. Now, there may be a sense of a cost of delay. While the buyer is deciding what to do - change or not change - the buyer may realize the enterprise is losing money. Once a goal has been shared, the seller is positioned to start developing the buyer's vision by using Sales-Primed Communications.

Patience and Intelligence

While having a buyer share a goal is a highly positive event, it also can be the catalyst that causes traditional salespeople to misbehave. Picture a traditional salesperson, for example, making a call on a finance executive. The executive says, "Our forecasting accuracy has been awful, and this is an area in which I'd like us to improve." What response will most traditional salespeople make in this situation?

If a traditional salesperson's process does not have patience built into it, he or she most likely will attempt to project his or her vision of a solution onto the buyer, rather than developing a vision that the buyer owns. Many launch right into something to the effect of, "Here's what you need to improve forecasting accuracy!" Then begins the intense "spray and pray" of features, many of which the executive doesn't understand, isn't interested in, and may not even need. Mix in some ownership for the vendor or seller achieving the buyer's goal, and you have a potential lost opportunity.

Sharing a seller's opinion or trying to impose that opinion on a buyer won't work in most cases. Instead, once a goal is shared, the traditional salesperson needs two qualities in order to take a Customer-Focused next step:

A questioning etiquette that provides artificial patience to avoid giving the seller's opinion of what the buyer needs.

Artificial intelligence in the form of questions designed to (1) understand the buyer's current environment, (2) understand what parts of the offering are needed, and (3) propose usage scenarios to the buyer.

These two components, integrated in the Solution Formulator (SF), provide a template enabling sellers to deliver Sales-Primed Communications. These templates help traditional sellers become Customer-Focused by leading the buyer to a vision of a solution that the buyer owns.

Let's say a CFO expresses a desire to improve forecasting accuracy. The Customer-Focused way for sellers to exhibit patience and frame the conversation is to ask, "How do you forecast today?" This allows the buyer to discuss his or her current approach, which in turn allows the following positive things to happen:

The salesperson gains an understanding of how the CFO currently forecasts.

The cost of poor forecasting and / or the potential benefit of more accurate forecasting can be established.

The usage scenarios the buyer is most likely to want and need can be uncovered and offered.

Usage scenarios the buyer is unlikely to need can be identified and avoided.

The buyer concludes that the salesperson is competent, by virtue of being able to ask intelligent questions related to forecasting accuracy.

The buyer concludes that this salesperson is different from the negative stereotype.

The seller allows the buyer to decide which usage scenarios are needed.

The buyer can decide if having those usage scenarios would empower him or her to achieve the goal of more accurate forecasting.

While few would disagree that these are all great outcomes, it is sobering to realize that the vast majority of salespeople (90 percent?) will be unable to achieve them without Sales-Primed Communications, which ultimately positions a company's offerings. Once the components of a conversation (vertical industry/title/goal) have been established, salespeople can benefit by executing Solution Formulators. Sales organizations can also benefit because the output of these calls becomes more objective and less dependent on the salesperson's biased opinion.

Good Questions, in the Right Sequence

In the balance of this chapter, we're going to describe, step by step, how a seller would use a Solution Formulator to develop the buyer's vision. First, though, it might be helpful to think about the different types of questions that can be asked, and when to use each:

Open questions require "essay" answers, allowing the buyer to take the conversation anywhere. Buyers feel safe, but the downside is that the conversation may not go in the direction the traditional salesperson wants to go. The only open question contained in Customer Focused Sales is: "What are you (or your organization) hoping to accomplish?" This allows buyers to talk - but if they don't bring up a business objective, the salesperson has the menu of goals from the Targeted Conversations List as a safety net to steer the conversation.

Framing questions offer the best of both worlds, in that the buyer is free to expound, but the salesperson has placed boundaries on the direction the response can take. "How do you forecast today?" is not an open question, because the response will relate to a topic the salesperson wants to discuss: forecasting. Questions beginning with the word how help facilitate conversational sales calls. Buyers do not feel "sold" when salespeople ask framing questions.

Closed questions require short, specific answers. Potential answers to a closed question would include yes, no, a number, and so on. Closed questions are best used after framing questions, to drill down on and quantify specific areas. Also, note that the only way a salesperson can convert a usage scenario to a capability is by posing a yes/no question to the buyer and getting an affirmative response.

Once a buyer has shared a goal, we recommend starting with a framing question beginning with the words: "How do you ________ today?" It is a logical, safe question that is virtually guaranteed to get buyers to describe their current process, which is exactly where a Customer-Focused salesperson wants to go.

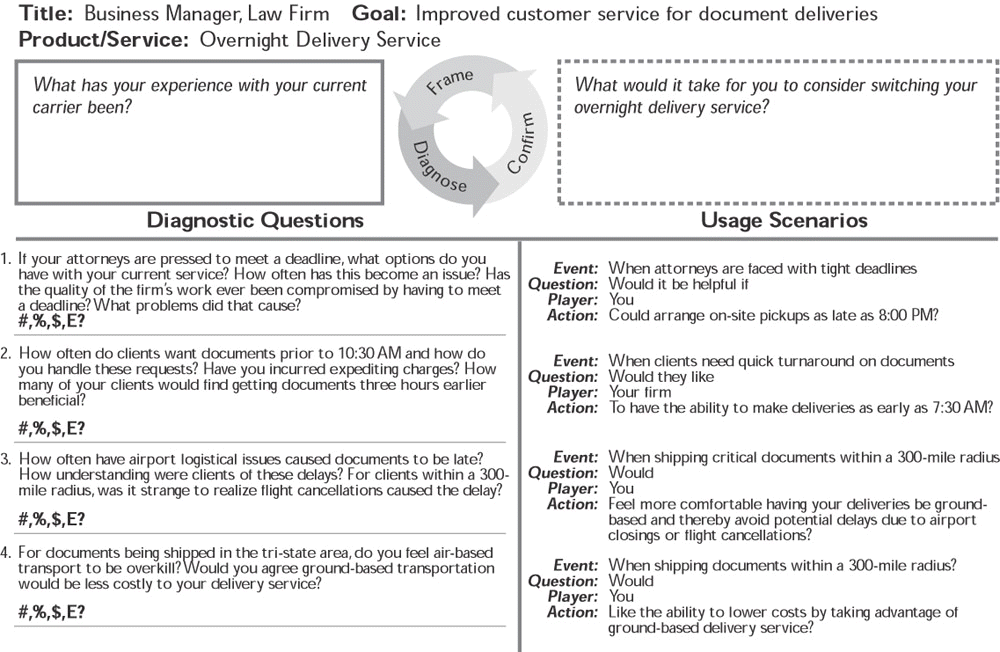

Once a buyer has responded, it is time to follow up with diagnostic questions, ideally biased toward usage scenarios that your offering provides. In order to accomplish this, as previously noted, we adhere to Stephen Covey's concept of "starting with the end in mind." That is the reason why, in Chapter 8, we developed the potential capabilities using the EQPA (event, question, player, action) formula, in the form of usage scenarios on the right side of the Solution Formulator. We then built the diagnostic questions on the left side (see Figure 8-1).

These diagnostic questions are now used to discover which usage scenarios the buyer is likely (and unlikely) to want. The salesperson follows up with the buyer by asking the questions in a sequence that flows within the call, takes detailed notes, and - when finishing the diagnosis - does a summary to make sure both the buyer and the seller are on the same page.

A Good Conversation

Let's walk through a dialogue between a Customer-Focused salesperson and a targeted decision maker at the VP of Finance/CFO level. (Refer back to Figure 8-3.) The decision maker wants to forecast more accurately, and the salesperson is using a Solution Formulator developed for selling sales force automation/customer relationship management (SFA/CRM) applications:

Salesperson: How do you forecast today?

Buyer: With great difficulty. Our overly optimistic VP of Sales gives me a monthly forecast that I have to reduce by about 50 percent just to be close. Even then, many of the specific opportunities he forecasts will close do not. Luckily, we get some unexpected business most months, or we would really be in a pickle!

Salesperson: How do your forecasting metrics vary by district?

Buyer: We have hired sales managers from a number of major companies, and they all seem to have their own way of qualifying and grading opportunities. At this point, I don't believe we have a standard grading system that is enforceable.

Salesperson: How many salespeople do you have, and do many rush or feel pressured to do their forecasts?

Buyer: We have 200 salespeople, and from what I hear they all despise forecasting.

Salesperson: Do you think those who are below quota are overoptimistic in an attempt to show enough in their forecast so it looks as though they are going to get caught up?

Buyer: That seems logical to me. It would be best to verify that with some of our sales staff.

Salesperson: How do salespeople report progress to their managers on opportunities in the forecast?

Buyer: I'm led to believe it is done on an ad hoc basis. Sales managers are asking questions as the forecast is being created.

Salesperson: How do your managers determine which opportunities on the forecast are stalled?

Buyer: There doesn't seem to be any standard way. Even if managers know an opportunity is stalled, they seem reluctant to remove anything from the pipeline. We recently closed a deal that had been on the forecast for 13 months! When I ask if an opportunity should be removed, my VP of Sales reminds me of the one that took 13 months to close.

Salesperson: How do managers assess the current status of opportunities? How do they coach reps to qualify and disqualify prospects?

Buyer: If we have a way to assess the status of an opportunity other than calling the salesperson and asking his or her opinion about an account, I am unaware of it. I believe our managers pressure more than they coach - especially at quarter's end.

Salesperson: Do forecast probabilities vary by salesperson?

Buyer: Based on the experience and year-to-date (YTD) quota position of the salesperson, they vary widely. There are a limited number of reps in whom we have a high degree of confidence as relates to bringing in what they projected.

Salesperson: How do sales managers adjust for this, and do you adjust the numbers you get?

Buyer: I would hope managers would take close rates of salespeople into account, but it must be on a seat-of-the-pants basis. Managers are under pressure as well, so their YTD position against the district's quota also affects forecasting at this level. As I mentioned earlier, I typically adjust the number I get from my VP of Sales by about half.

Salesperson: If one or two large opportunities can make or break a forecast, how do you track those prospects?

Buyer: We missed our year-end earning target because two large opportunities that were supposed to close by December 31 didn't. Here it is, almost the end of March, and still neither one has closed. So yes, absolutely, large opportunities can make or break a quarter! But other than every C-level executive in the place calling the VP of Sales twice a day, there is no way for us to track those large opportunities.

Salesperson: What would better visibility on these opportunities mean to you?

Buyer: As CFO, I can deal with bad news much more effectively if there is some lead time. If a large opportunity drops off the forecast early in a quarter, we can do some belt tightening and hopefully find some other sources of revenue. My job is immeasurably harder with "high-wire act" finishes to our quarters. Any bad news from sales late in the quarter becomes an unpleasant discussion in staff and board meetings.

Salesperson: Let me summarize what we have covered so far. You have difficulty forecasting revenue, and it has affected your ability to hit your earnings targets. There is no consistent, companywide standard to use when grading opportunities. Unqualified opportunities find their way into your pipeline. It is difficult for managers to track progress. Close rates vary widely between salespeople, and you have a difficult time keeping updated on make-or-break deals. Ultimately, you have to reduce the forecast you receive by as much as 50 percent. Is that a fair summary?

Buyer: Yes, that pretty much describes how things happen today.

Salesperson: What approaches have you considered to improve forecasting accuracy?

Buyer: Other than changing Vice Presidents of Sales every couple of years, I am not sure what else we have tried or could try. I've had several sales executives in my career tell me that I just didn't understand sales.

Salesperson: Based on our discussion so far, may I offer a few suggestions?

Buyer: Please do.

Salesperson: After making sales calls, would it help if your salespeople were prompted to report progress on that call against a standard set of company milestones for each opportunity in their pipeline?

Buyer: I have been clamoring for a standard set of milestones we could all use and understand. Prompting the salespeople seems like a good way to collect data after each sales call. I believe it would help.

Salesperson: When reviewing a salesperson's pipeline, would it be useful if your sales managers could access a secure central database from any location, evaluate the status of opportunities, and email suggestions to reps to improve the chances of winning the business?

Buyer: I believe so. We didn't discuss it, but many salespeople work out of remote or home offices.

Salesperson: On an ongoing basis, would you like a system that would track historical close rates for each salesperson by milestone, and apply them to your pipeline to help you predict revenue?

Buyer: I would like that! I might not have to tweak the numbers by 50 percent or more. It would be refreshing to apply a little science and logic to our forecasting process.

Seller: When evaluating the status of large opportunities, would it be beneficial if you or any C-level executive could access a central database via laptop anytime / anywhere, and review progress against milestones without having to talk to your VP of Sales?

Buyer: Yes.

Salesperson: If you had standard milestones updated after each sales call, an accessible pipeline database for coaching and reviewing progress, the ability to track historical close rates by milestone, and the ability to assess make-or-break opportunities from your laptop, do you think you would be able to achieve your goal of more accurately forecasting revenue?

Buyer: Yes, and I'd feel more confident going into board meetings if we had a better handle on forecasting.

This conversation, of course, is something of an ideal. The role-play coaches, who serve as buyers, are passive and cooperative the first time through so as to allow participants to walk before they run. The subsequent six role-plays become more challenging and realistic.

In the example above, the seller enjoyed the luxury of having a buyer readily share a goal and be willing to engage in a candid and pointed conversation, with the salesperson doing a lot of directing (through questioning). In sales calls, conversations almost never follow a script. But the SF provides a guideline for (1) diagnosing the buyer's current situation with a bias toward your offering, and (2) developing a custom vision that the buyer owns. Please note that in this example, the buyer agreed to all four major diagnostic questions, and therefore the seller offered all four usage scenarios. In making calls, if a buyer does not agree to a reason the company cannot achieve a goal, the seller would not offer the corresponding usage scenario.

Competing for the Silver Medal?

Now let's now look at a more difficult conversation. This is a phone call, initiated by a lower-level buyer doing due diligence to justify buying from Column A:

Buyer: Hello. This is Anita Quote with the ABC Company. We have decided to purchase CRM software. We have budget, and we want to make a decision soon. How quickly can you provide a demonstration, pricing, and a proposal?

Salesperson: First, can you tell me your role at ABC Company?

Buyer: I'm a senior analyst in our IT department.

Salesperson: It would be helpful if I could first get a sense of what your organization is hoping to accomplish with your CRM system.

Buyer: At this stage, I'm not prepared to get into a detailed discussion. What I really want is pricing information to determine if you should be placed on our short list of CRM vendors.

Salesperson: In order to make a recommendation, l need to get a better understanding of your requirements. Some of the other companies I've worked with were attempting to improve in one or more of the following areas:

Reduce the cost of sales

Increase cross selling

Improve forecasting accuracy

Increase sales revenue

Are any of these objectives driving your company's evaluation of CRM?

Buyer: Our major objective is improving forecasting accuracy, but as I've said, I don't have time to have a detailed discussion.

This buyer's attitude is significantly different from that in the previous call on the CFO. This buyer already has an idea of what she wants. It's possible that she's already settled on one of your competitors, and is feigning interest, either to satisfy her company's bid procedures or with the intent of using your price as a lever to negotiate the best deal from Column A.

At the end of the dialogue presented above, you are very likely to get a poor response to the question: "How do you forecast today?" But an alternative is to ask: "As relates to forecasting, what specific CRM capabilities are you looking for?" Or, "How would you use a CRM system to forecast?" These questions encourage the buyer to share what she has settled on so far. They may also elicit an answer that tells you that Column A has not created capabilities to help the buyer fully understand how their offering could be used. Sometimes - based on the buyer's response and use of industry buzzwords - it is possible to determine which sales organization occupies Column A.

After the buyer has responded, your mission is to clarify in your mind (and potentially the buyer's mind) what capabilities are needed. Ideally, you can extend the list of requirements by adding a capability that the competition does not have - or that your traditional salesperson competitor might have failed to discuss, because he or she did not have Sales-Primed Communications and was forced to wing it.

When dealing with a buyer who does not appear to want to have an open discussion, we suggest asking yes/no questions, going down the right side of the Solution Formulator to determine which capabilities the buyer will agree to. The most typical responses:

"Yes, we want that" tells you that most likely Column A has already made that a requirement.

"That isn't one of our requirements, but it could be helpful" is the best response, because it indicates that you may have the potential to introduce a different requirement. When you are coming in as Column B, the best way to improve your chances of winning is to bring up requirements Column A either can't meet or hasn't discussed.

"No, that isn't something we need" can be true, but there are a few other possible interpretations. It could be that the buyer doesn't fully understand the usage scenario, or it could be that you are calling on the champion of Column A, who doesn't want to change the existing specification. In any case, if you feel it is a capability that you would like to introduce, we'll show a fairly gentle way to make another attempt later in the call.

By asking the EQPA questions, you are earning the right to ask, "How are you currently forecasting?" At this stage in the call - as opposed to right after getting a reluctant buyer to share a goal - you may have established enough credibility (and earned enough space) in the mind of the buyer to get a reasonably detailed answer. Once the buyer has finished his or her answer, you can then ask the diagnostic questions corresponding to the capabilities agreed to. If by asking diagnostic questions you begin to build a case in the buyer's mind for a capability that was initially dismissed, you can do a minisummary and ask the capability questions again.

Vision Building around a Commodity

Solution Formulators can be used to facilitate virtually any sales discussion that can be distilled down to a buyer and business issue. We have worked with companies that sell what is perceived as a commodity, and - with some modifications - the vision-building model still works.

Let's say, for example, that you are a regional overnight delivery service, and you have the following differentiators when compared to national carriers:

You can accept pallets.

Your weight limits on packages are higher.

Pickups can be made as late as 8:00 PM.

Deliveries can be as early as 7:30 AM.

All shipments are ground-based and within a 300-mile radius.

You can deliver to a construction site without an address.

You can offer a 20 percent savings over national carriers.

In this case, nearly every prospect on whom you're calling is already using and familiar with one or more overnight delivery services. Many traditional salespeople would lead with price in this situation, but this is a dangerous approach. Many customers would conclude that they would receive inferior service from a previously unknown carrier who initiates a discussion based on lower price. Another problem with this approach is that it creates a commodity sale mentality. Even if successful in generating interest, the buyer is likely to invite other carriers in to have them compete on price.

In selling situations such as this, it is important to give the buyer a reason to be unhappy with the current service. This can be done by selecting a Success Story highlighting one of your strengths and one of a national carrier's potential weaknesses.

The question that follows a Success Story can't be too obvious. For example: "How do you handle your overnight deliveries today?" is so basic as to be insulting. Since most people feel they understand how to use an overnight delivery service, a more appropriate question would be: "What would it take for you to consider switching overnight delivery companies?"

After getting the buyer's response, you can then ask the usage scenario questions on the right side of the Solution Formulator, with each of them being a potential differentiator. The seven differentiators listed above would have to be chosen judiciously, based on the title and industry the salesperson is calling on. A manufacturing company may be interested in shipping pallets, but a law firm or a bank would not be. Do your homework, here: A company billing its clients on a cost plus basis might not find a lower price attractive.

Let's assume that you (again, a representative for the regional overnight delivery service described above) are calling on the office manager of a law firm. After a brief introduction and Success Story about another law firm that elected to use your service, the conversation might go as follows, using the SF shown in Figure 11-1.

Salesperson: What would it take for you to consider switching overnight delivery companies?

Buyer: We're pretty satisfied with FBN Overnight Delivery's service.

Salesperson: Most people are satisfied with FBN, but let me ask: When attorneys are faced with a deadline, would it be helpful if you could arrange on-site pickups as late as 8:00 PM?

Buyer: We usually can get things done by 5:00, but 8:00 would be helpful to us.

Salesperson: When clients need quick turnaround, would you like to be able to have deliveries to them made as early as 7:30 the next morning?

Buyer: Some of our clients would want contracts or documents that early.

Salesperson: When shipping critical documents within a 300-mile radius, would you feel more comfortable having your deliveries be ground-based, and thereby bypass delays due to airport closings and similar problems?

Buyer: We really haven't had many issues related to weather delays in deliveries.

Salesperson: When shipping documents within 300 miles, would you like the ability to lower overall costs by using ground-based delivery?

Buyer: Our clients have become very cost-conscious, so we would be interested in reduced shipping costs. In fact, now that I think of it, most of our clients are local.

What's happened here? You've gotten a lukewarm response to the third usage scenario, but the buyer has responded well to the other three. After framing a question - such as, "What has been your experience with FBN's services?" - to bring the conversation to the left side of the SF, you would do the diagnosis for reasons 1, 2, and 4 to obtain details and quantification on how not having the corresponding capabilities is affecting the business manager and the law firm. After summarizing the diagnosis, you would then summarize the buyer vision and seek the buyer's agreement:

Salesperson: To summarize, if you could have the abilities to arrange pickups as late as 8:00 PM, arrange deliveries as early as 7:30 AM, and reduce the cost of next-day deliveries, then would you consider trying our service?

Buyer: Certainly I would be interested. First I want to take a further look at your company. If things check out, I would be willing to give you a try.

There is no right or wrong way to navigate an SF, provided a seller can end with a question to verify the buyer vision. Given a choice, we prefer doing the diagnosis (left side) first, but the primary consideration is being in alignment with the buyer. If a buyer already knows what he or she wants, begin with the usage scenario questions.

The purpose of the Solution Formulator is to arm sellers with artificial patience and artificial intelligence to determine which usage scenarios the buyer is likely to need, simply by asking questions. These usage scenarios become capabilities when the buyer agrees they would be useful. The final step is to see if by using all the capabilities, the buyer would be empowered to achieve the desired goal. This is accomplished by asking, "If you had (summarize the capabilities), then could you achieve (buyer goal)?"

Once a buyer vision has been created, you should see if the buyer will share any additional goals, so you can create further visions and develop associated value. After developing shared buyer goals, the next step is to begin qualifying the buyer - a critical requirement in successful selling that we'll cover in the next chapter.